European companies make many important investments in Japan – there are many success stories

European companies have done business with Japan for 100s of years

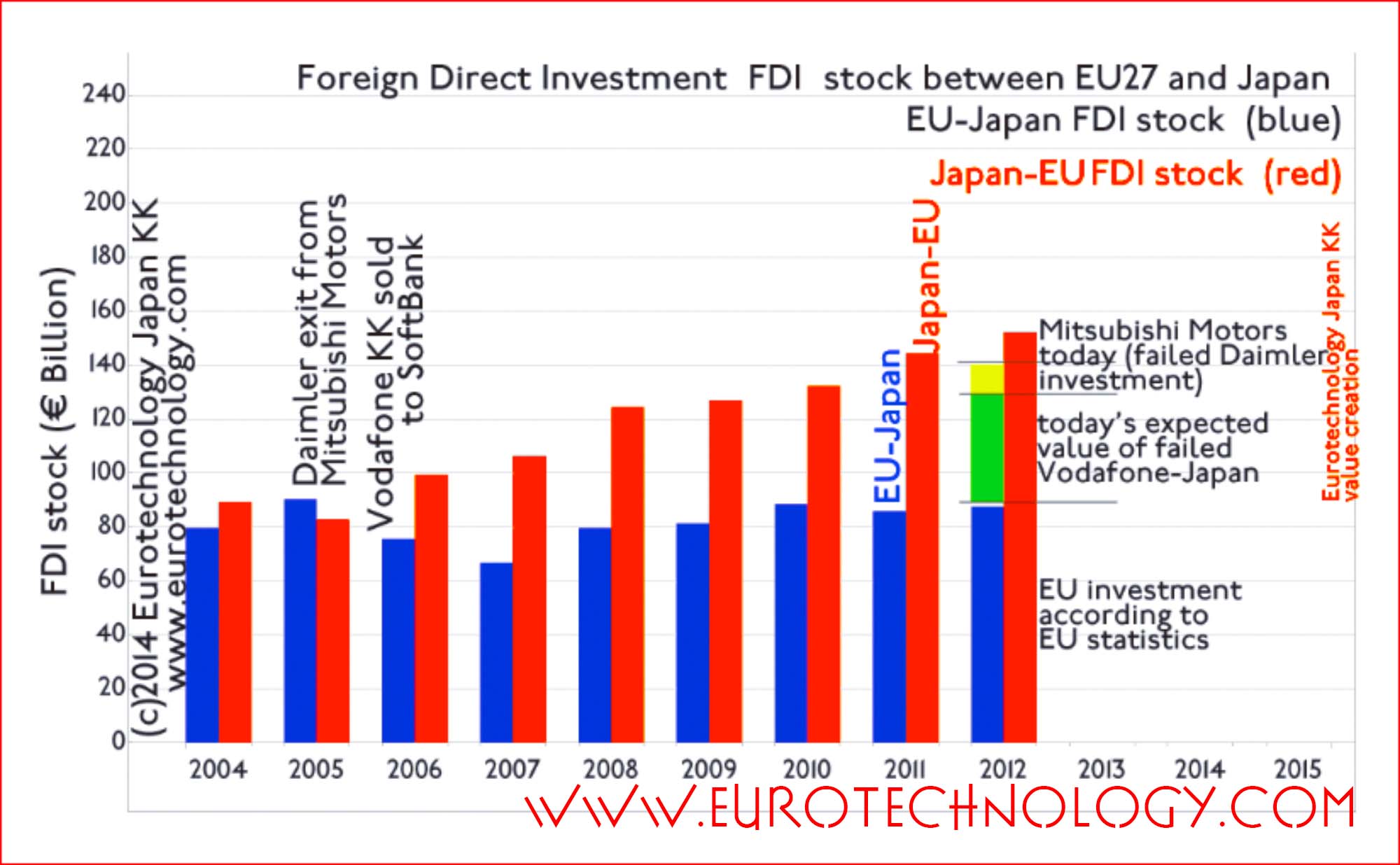

European companies have been investing directly in Japan and in Japanese companies for 100 years or longer, and European investments to Japan now amount to around EURO 80 billion in total, are stable, but there is not much growth currently. There is hope that the expected Economic Partnership Agreement (EPA) will lead to higher European investments in Japan.

European investments to Japan have seen ups and downs: some are successful beyond expectations – an outstanding example is the success of the Renault – Nissan partnership accompanied by mutual investment. Unfortunately there are some other EU investments to Japan which have failed, among them is the Vodafone acquisition of Japan Telecom and J-Phone which was later sold to SoftBank in several transaction, and which contributed to SoftBank’s success.

Europe to Japan investment stock

Several major European direct investments in Japan failed, by far the largest failures were Vodafone-Japan and Daimler’s investment in Mitsubishi Motors. Had these two businesses been successful, the EU director investment stock in Japan would today be much higher as shown in the following figure, and as discussed in detail in our blog article “EU Management: what is the value of good management in Japan?”.

Combined European investments in Japan could be at least 50% higher with better management

Several very large European direct investments in Japan did not succeed, for example Vodafone’s acquisition of Japan Telecom, or Daimler’s acquisition of Mitsubishi Motors, and there are many more examples. It can be argued that European investments in Japan combined could be 50% higher overall, if these acquisitions would have been successfully managed:

- EU investment in Japan could be 50% higher had Vodafone succeeded in Japan

- EU investments in Japan: Why did Vodafone fail in Japan?

- EU Japan management: what is the value of good management in Japan?

Europe to Japan investment flow

Overview of the direct investment flow and investment stock between Europe and Japan.

Europe to Japan direct investment register: EU companies investing in Japan and acquiring Japanese companies

Note: this register focuses on investments and acquisitions by EU companies in Japan, however we do include also a limited amount of not strictly EU companies, e.g. some Israeli, Swiss and other not strictly EU companies. In any case, according to Carlos Ghosn: “companies have no nationality”.

2014

- NOKIA to acquire Panasonic’s mobile phone base station unit Panasonic System Networks acquisition value YEN several billion (US$ 10s million). For analysis of Japan’s mobile phone base station market, see Eurotechnology report on Japan’s base station market. Details of the Nokia-Panasonic transaction here.

- Colt, “The information delivery platform” acquires Tokyo-based KVH, “Asia’s information delivery platform” subject to approval by Colt’s shareholders at the shareholder meeting on Dec 16, 2014. Acquisition price is YEN 18.595 billion (€ 130.3 million = US$ 160 million). For details read here.

2013

- (December 23, 2013): TowerJazz (an Israeli-US semiconductor IC fab company) acquires three IC fabs from Panasonic: on April 1, 2014, TowerJazz and Panasonic Semiconductors Ltd will create a Joint-Venture “TowerJazz Panasonic Semiconductor Co Ltd”, which will be owned 51% by TowerJazz and 49% by Panasonic, with a capital of YEN 750 million (US$ 7.5 million).

2012

- BOSCH sells remaining shareholding in DENSO. Starting in 1953, BOSCH had entered into licensing agreements with DENSO, licensing BOSCH technology to DENSO and in turn took ownership of part of the outstanding shares of DENSO. In November 2012, BOSCH decided to sell the remaining 46 million shares, corresponding to a 5.4% holding for EURO 1.1 billion, reducing the shareholding to zero.

- BOSCH Packaging Technologies acquires Eisai Machinery In April 2012, BOSCH Packaging Technologies KK acquires Eisai Machinery, which in 2010 had annual turnover of about EURO 76 million.

- London Stock Exchange divests Tokyo AIM investment and withdraws from Japan. London Stock Exchange had entered into a Joint-Venture with Tokyo Stock Exchange to build the Tokyo AIM stock market modeled after the London AIM market. However, on March 26, 2012, NIKKEI reported that “Tokyo Stock Exchange has learnt enough from the London Stock Exchange to set up a similar market on its own. TSE plans to improve the rules of its own new market, so that TSE can create a more welcoming market”. Read details here.

2011

- TowerJazz (an Israeli-US semiconductor IC fab company) acquires Micron IC fab in Nishiwaki TowerJazz acquires Micron IC fab in Nishigaki (Hyogo-ken) for a total amount of US$ 140 million (US$ 40 million in cash + US$ 19.7 million in TowerJazz shares + US$ 80.3 million estimated pension payment obligations).

2010

- Nissan Diesel changes name to UD Trucks. Nissan Diesel is owned 100% by Volvo AB.

2009

- Volkswagen (VW) acquires 19.89% of Suzuki Motors for EURO 1.7 billion with the plan of a Volkswagen-Suzuki alliance. This alliance ran into management difficulties, which have been brought into public view by a blog post by the Suzuki CEO Mr Osamu Suzuki. Suzuki wishes to dissolve this alliance, and asks Volkswagen to sell the shares of Suzuki owned by Volkswagen.

- London Stock Exchange (LSE) invests YEN 98 million for a 49% stake in Tokyo AIM (January 29, 2009). London Stock Exchange and Tokyo Stock Exchange created the Tokyo AIM Market as a joint-venture to be owned 51% by Tokyo Stock Exchange, which invested YEN 102 million (US$ 1.02 million), and 49% by London Stock Exchange which invested YEN 98 million (US$ 0.98 million). This joint venture was dissolved, Tokyo Stock Exchange (TSE) took 100% control and renamed the Tokyo AIM market into Tokyo Pro Market, and Tokyo Pro-Bond Market, while London Stock Exchange withdrew from the Japanese market.

Read details here.

2008

- Iscar acquires Tungaloy US$ 1 billion, for details see: “Iscar Ltd of Israel acquired Japanese tungsten carbide tool maker Tungaloy for US$ 1 billion“

2007

- Permira acquires Arysta Life Science Corporation US$ 2.2 billion

- Volvo acquires all remaining outstanding shares of Nissan Diesel in a tender offer, open for 22 days between Wednesday 21 February 2007 – 23 March 2007 for YEN 135 billion (February 21, 2007). Volvo offered YEN 540 per share, 22% higher than the closing price on Monday February 19, 2007. Volvo will also take over Nissan Diesel’s debt of SKr 7.5 billion.

2006

- Softbank acquires Vodafone KK, Vodafone essentially withdraws from business in Japan. On March 17, 2006, Softbank announced an agreement to acquire the 97.7% of Vodafone KK held by the Vodafone Group. The transaction value is estimated at YEN 1750 billion (US$ 15 billion). For an details of this transaction see the explanations and graphics in our SoftBank report. With this transaction, the Vodafone Group essentially terminated direct business in Japan, and withdrew from Japan. Read here an analysis on why Vodafone failed in Japan, sold to SoftBank and withdrew from Japan.

- Volvo acquires 57.5 million preferred shares of Nissan Diesel for SKr 3.5 billion, which will be converted into ordinary shares starting in 2008, which will eventually increase total ownership to 46.5%

- Volvo acquires 18,211,000 shares in Nissan Diesel plus 19,998,000 preferred shares from Nissan for SKr 0.5 billion, exercising an option This holding corresponds to 6% of outstanding shares of Nissan Diesel, taking the total ownership to 19%.

- Volvo acquires 13% of shares of Nissan Diesel from Nissan for SKr 1.5 billion in March 2006, Nissan to focus on passenger cars and light commercial vehicles.

- Atlas Copco KK acquires Fuji Air Tools Co Ltd. (February 24, 2006) Fuji Air Tools (correct company name: 不二空機株式会社 FUJI INDUSTRIAL TECHNIQUE CO., LTD.), is an Osaka based Japanese tool manufacturer founded in June 1943. Annual sales are approximately YEN 2.75 billion (US$ 27.5 million)

2005

- DaimlerChrysler withdraws from Mitsubishi Motors DaimlerChrysler sells all remaining shares (12.4%) to Goldman Sachs for US$ 1.1 billion on November 11, 2005, and withdraws completely from Mitsubishi Motors.

- Mitsubishi Motor Corporation sells all remaining of Mitsubishi Fuso Truck and Bus Corporation shares to DaimlerChrysler new ownership of Mitsubishi Fuso Truck and Bus Corporation:

- DaimlerChrysler (85%),

- other Mitsubishi Group Companies (15%)

- At a later stage the Daimler AG holding is increased, and Mitsubishi Fuso Truck and Bus Corporation becomes an integral part of the Daimler Trucks Division. New ownership is:

- DaimlerChrysler (89.29%),

- other Mitsubishi Group Companies (10.71%)

- MAHLE Izumi Corporation name changed to MAHLE Engine Components Japan Corporation.

2004

- DaimlerChrysler’s holding in Mitsubishi Motors reduced to 12.4% as a consequence of a rescue investment package.

- Mitsubishi Motor Corporation sells part of Mitsubishi Fuso Truck and Bus Corporation shares to DaimlerChrysler new ownership of Mitsubishi Fuso Truck and Bus Corporation:

- DaimlerChrysler (65%),

- Mitsubishi Motors (20%) and

- other Mitsubishi Group Companies (15%)

- SoftBank acquires Cable & Wireless IDC KK for UKL 72.4 million plus assumes UKL 9.5 million in debt, as announced on October 26, 2004. For details see: “Cable & Wireless Japan acquired by SoftBank?“

With the sale of Cable & Wireless IDC KK, Cable & Wireless exited the Japanese market.

For details see this report on SoftBank.

2003

- J-Phone name changed to Vodafone on October 1, 2003. in a series of transactions Vodafone has acquired control of Japan-Telecom, and of the mobile operator J-Phone, changing the name from J-Phone to Vodafone completes the acquisition of mobile operator J-Phone and integration into the Vodafone group.

- J-Phone’s mobile internet service J-Sky renamed Vodafone Live! on July 15, 2003. J-Sky is one of the first mobile internet services globally, which started a few months after Docomo’s introduction of i-Mode in February 1999. Vodafone, renamed J-Sky into Vodafone Live!, and introduced J-Sky’s technologies and business models to other markets including UK and Germany.

- Mitsubishi Fuso Truck and Bus Corporation established with 43% ownership by DaimlerChrysler Ownership of Mitsubishi Fuso Truck and Bus Corporation is owned by:

- DaimlerChrysler (43%),

- Mitsubishi Motors (42%) and

- other Mitsubishi Group Companies (15%)

- Mahle increases ownership of Izumi Motor Corporation, name changed to MAHLE Izumi Corporation. German engine components maker MAHLE entered into a cooperation agreement with Izumi Motor Corporation in 1968, and in a series of transactions in 1998, 1999, 2003 (YEN 1.25 billion) increased capital of Izumi Motor Corporation.

2002

- September 9, 2002: Schneider Electric acquires 35% of Digital Electronics and launches a take over bid for the remaining capital of Digital Electronics Corporation (株式会社デジタル), which was founded on July 22, 1972 as デジタル電子株式会社, this name was changed to 株式会社デジタル in 1974.

- Cable & Wireless IDC acquires PSINet Japan Inc for US$ 16.6 million. Initially on Dec 10, 2011 a lower purchase price was announced in the bankruptcy court in the auction of the bankrupt PSINet Japan.

2001

- Vodafone acquires 10% of Japan Telecom from AT&T for US$ 1.35 billion, achieving 25% ownership of Japan Telecom, which has a market capitalization of US$ 9.29 billion. Japan Telecom owns 54% of the mobile operator J-Phone, and Vodafone’s effective ownership of J-Phone became 35%.

- Vodafone acquires 15% of Japan Telecom from West Japan Railways and Central Japan Railways for US$ 2.5 billion

- DaimlerChrysler acquires VOLVO’s 3.3% stake in Mitsubishi Motors for EURO 760 million, increasing DaimlerChrysler’s ownership of Mitsubishi Motors to 37.3%.

- Renault increases investment in Nissan to 44.4% In October 2001, Renault acquired an additional 7.6% of Nissan for EURO 1.4 billion, taking the total ownership of Nissan from 36.8% to 44.4%.

2000

- DaimlerChrysler acquires 34% of Mitsubishi Motors on March 27, 2000 DaimlerChrysler acquired 34% of Mitsubishi Motors for YEN 450 billion (= EURO 2.1 billion) and sent 3 out of 10 Board Directors. Due to a recall scandal at Mitsubishi Motors, this acquisition price was reduced by EURO 200 million to EURO 1.9 million, and Rolf Eckrodt was sent as COO to Mitsubishi Motors. Rolf Eckrodt later became Chairman and CEO of Mitsubishi Motors and retired in April 2004.

1999

- Renault-Nissan Alliance starts on March 27, 1999. Renault acquires 36.8% of Nissan’s outstanding shares, and Nissan promises to invest in Renault at a future date: in 2001, Nissan acquires 15% of Renault.

- AB VOLVO acquires 5% of Mitsubishi Motors Corporation (later sold to DaimlerChrysler)

- Cable & Wireless acquires 97.69% of International Digital Communications (IDC). This acquisition was a tender offer for the public shares of IDC, where two interested purchasers competed: NTT and Cable & Wireless. Initially NTT’s offer was better than Cable & Wireless’ offer, however Cable & Wireless later improved the offer and won the acquisition. This acquisition is sometimes described as “hostile”, but we don’t believe that this is a good characterization of the transaction. C&W’s offer valued IDC at 69 billion yen. IDC already owned 17.69%, and paid 55.2 billion yen to 134 of IDC’s 140 other shareholders, increasing ownership to 97.69%.

Ultimately Cable & Wireless did not have the capability to manage this Japanese company, sold all of Cable & Wireless IDC to SoftBank on Oct. 26, 2004 five years later, and quit Japan. - Robert Bosch GmbH increases ownership of ZEXEL to 50.04% from 31.76% in February 1999. Robert BOSCH GmbH acquired an additional 90 million newly issued shares of ZEXEL. At the current stock price, this would correspond to DM 291 million.

- Mahle increases capital of Izumi Motor Corporation. German automotive parts supplier MAHLE increases ownership and capital of Izumi Motor Corporation.

- MAHLE acquires 57.72% ownership of Tennex Corporation. German automotive parts supplier MAHLE acquires 33.3% ownership of Tennex Corporation in April 1999, and in August 1999 increases ownership to 57.72%.

1998

- Mahle increases capital of Izumi Motor Corporation. German automotive parts supplier MAHLE increases ownership and capital of Izumi Motor Corporation.

1997

- Robert Bosch GmbH acquired a 31.76% ownership of ZEXEL Zexel was founded as Diesel Kiki Co Ltd in 1939, to produce fuel injection pumps for diesel engines under Robert Bosch licenses. Diesel Kiki was renamed Zexel in 1990.

1900

Samuel Samuel & Co incorporate the Rising Sun Petroleum Company to import petroleum into Japan.

1876

Samuel Samuel sets up the trading company Samuel Samuel & Co in Yokohama

1641-1854

In 1641 Dutch traders were moved from Hirado to Dejima and the Dutch East India Company (Vereenigde Oostindische Compagnie (VOC)) rented the land of Dejima from 25 local Japanese families.

1633-1853 Sakoku (鎖国)

Between 1633-1853 Japan was to some extent closed to the outside under the Tokugawa Shogunate.

However, during the Sakoku period trade continued in a strictly controlled way via designated ports in Nagasaki (with China, Holland and Korea), with the Ainu people in Hokkaido, and the Ryukyu Kingdom via the Satsuma Domain (today Kagoshima).

The Sakoku period started with policy decisions and laws by the Tokugawa Shogunate issued during 1633-1639, and ended with the arrival of the US “Black Ships” under Admiral Matthew Perry, who forced the opening of Japan to international trade.

1634-1639

Dejima (出島), an artificial island about 120 meters x 75 meters in size was created in Nagasaki to house Portuguese traders.

The Portuguese traders were expelled from Japan in 1639.

1609

The Dutch East India Company (Vereenigde Oostindische Compagnie (VOC)) established a trading post on the island of Hirado.

Copyright 2014-2020 Eurotechnology Japan KK All Rights Reserved