EU Japan investment (FDI), mergers and acquisitions (M&A)

The period of EU-Japan “trade friction” is long over, however European direct investments in Japanese companies is still at a fairly low level and stable, not growing. While the mutual EU-Japan investment partnership between Renault and Nissan is by all measures a huge success, there have been a number of very large and very visible failures of European investments in Japan, especially Vodafone-Japan, Cable & Wireless and several others. Future European investments in Japan have the advantage, that they can learn from both past success stories such as Renault/Nissan, but they can also learn from failures and strive to avoid to repeat the same mistakes.

M&A and direct investment (FDI) transactions:

Investment stock between EU and Japan

EU to Japan

Europe to Japan M&A, details of transactions

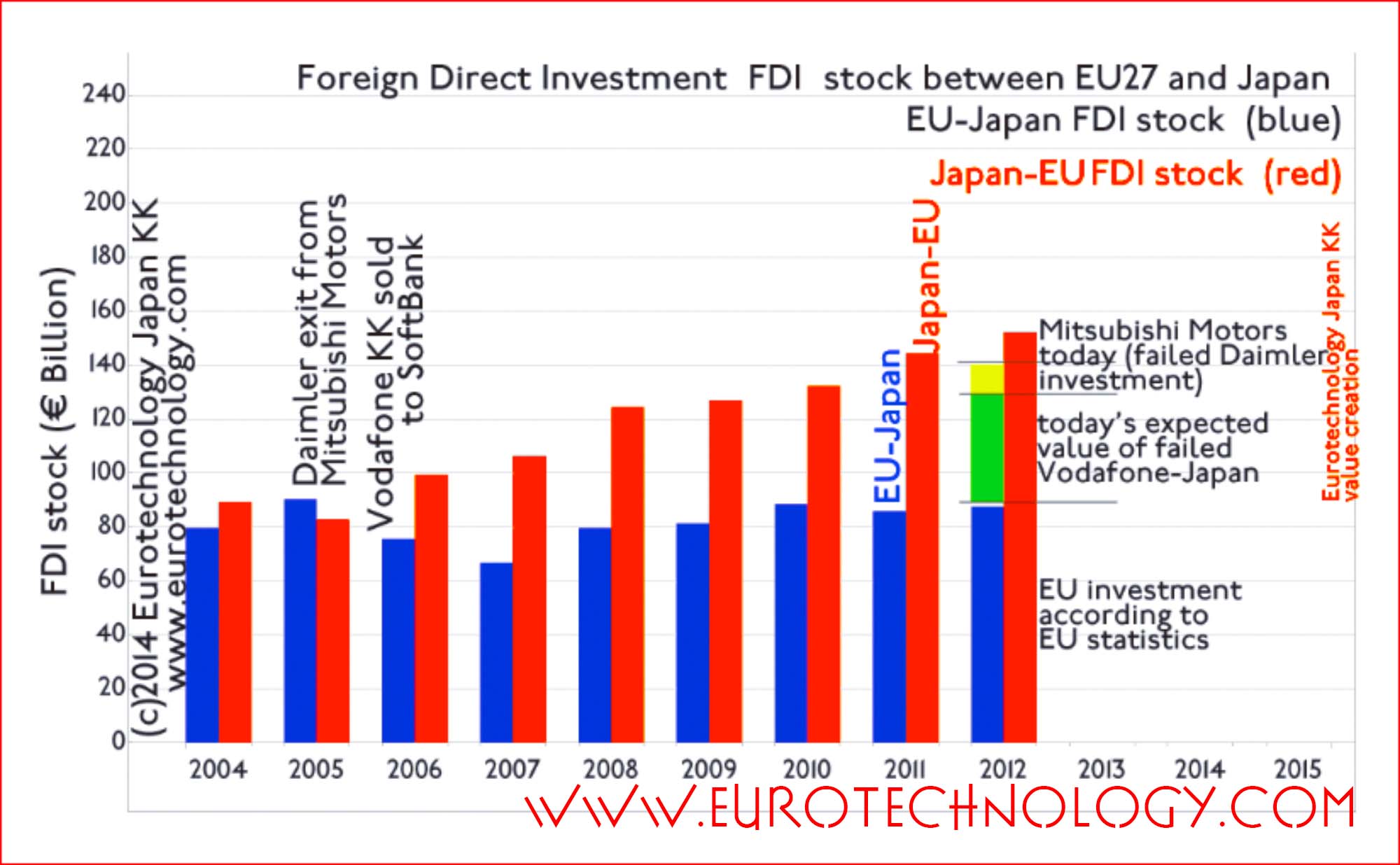

EU investments in Japan have been relatively constant around EURO 80 billion. There has been a marked reduction in EU investment in Japan in 2006 due to the withdrawal of Vodafone from Japan with the sale of Vodafone KK to Softbank for approx. EURO 12 billion (find details of the Vodafone-SoftBank M&A transaction here). This reduction of EU investment stock in Japan is clearly visible in the graphics below in 2006 and 2007.

Several major European direct investments in Japan failed, by far the largest failures were Vodafone-Japan and Daimler’s investment in Mitsubishi Motors. Had these two businesses been successful, the EU director investment stock in Japan would today be much higher as shown in the following figure, and as discussed in detail in our blog article “EU Management: what is the value of good management in Japan?”.

Japan to EU

Japan to Europe M&A, details of transactions

Japanese investments in EU are steadily increasing, as Japanese companies are seeking to grow business outside Japan’s saturated market, and as Japanese companies acquire European companies for market access, technology and global business footprint. In 2012 the total investment stock of Japanese companies in the EU-27 has reached around EURO 150 billion.

Investment flow between EU and Japan

Investment flow between EU and Japan shows strong impact from the Lehmann shock economic downturn. Investment flow from EU to Japan remains at relatively low levels around EURO 1 billion annually, while investments by Japanese companies in the EU are on the order of EURO 10 billion per year currently.

Mergers and acquisitions in Japan need a carefully structured and systematic process

Thorough preparations and a carefully structured and systematic approach reduces risks and increases the chances of success:

- M&A process

- Understand the industry: research

- Find and approach partners

- Build cooperation

- Stakeholders

- Due diligence

- Finance

- Negotiate and close agreements

- Post merger

Copyright (c) 2014-2017 Eurotechnology Japan KK All Rights Reserved