Tag: M&A

-

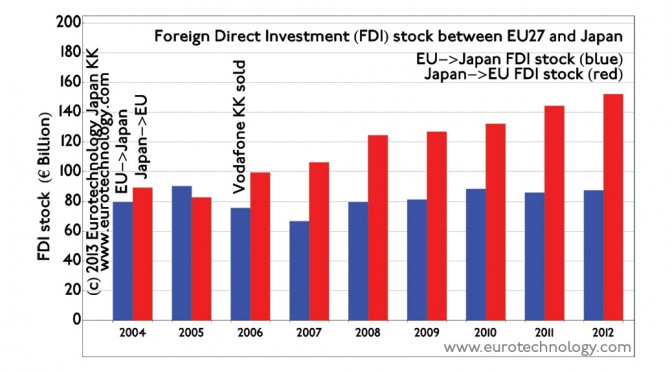

EU Japan investment stock

EU Japan investment stock EU Japan investment: EU to Japan EU to Japan investment register EU investments in Japan have been relatively constant around EURO 80 billion. There has been a marked reduction in EU investment in Japan in 2006 due to the withdrawal of Vodafone from Japan with the sale of Vodafone KK to…

-

Kyocera expands in Europe via acquisition of TA Triumph-Adler

by Gerhard Fasol Kyocera acquires Triumph-Adler for € 98.7 million Motivated by Triumph-Adler’s distribution network: 35,000 companies as customers in 33 countries Kyocera is one of Japan’s powerful electronics companies, which together are about as large economically as the whole of the Netherlands. Taking advantage of low EURO exchange rates and the high YEN, and…

-

Japanese M&A abroad: Four critical factors for Japanese corporates making major international acquisitions, Stuart Chambers, CEO of NSG Group

October 16, 2008 by Gerhard Fasol Stuart Chambers, CEO of NSG Group, gave a press conference on October 16, 2008, here are some notes and thoughts. On February 16th, 2006, Nippon Sheet Glass’ offer for the 80% of Pilkington plc it did not already own, for US$ 3.14 billion in total, was accepted by Pilkington’s…

-

Nokia & Sony Ericsson Results Likely to Disappoint (CNBC TV interview)

More in our J-ELECTRIC report: http://www.eurotechnology.com/store/j_electric/ Copyright·©2013 ·Eurotechnology Japan KK·All Rights Reserved·

-

Warren Buffet’s Iscar Ltd of Israel acquired Japanese tungsten carbide tool maker Tungaloy for US$ 1 billion

22 Sept 2008, author: Gerhard Fasol The Israeli company Iscar has completed the acquisition of Japanese competitor Tungaloy Corporation. Iscar acquired more than 90% of outstanding shares for around US$ 1 billion from Nomura Principal Finance Co. Iscar is the world’s second largest maker of tungsten carbide cutting tools, and competitor Tungaloy is the world’s…

-

A European perspective on M&A in Japan

Presentation at the lunch meeting of the Danish Chamber of Commerce in Japan (DCCJ) on June 4, 2008. Announcement Photos of the event Announcement text: With the very high EURO and low valuations of many Japanese companies, and with changing attitudes in Japan, now is an excellent time for European companies to start or expand…

-

Seminar in London: "M&A in Japan" (Friday 18 April 2008, 12:30-14:30)

Seminar Description: Two practitioners from Tokyo will debate the changes in Japanese attitudes to mergers and acquisitions. During the course of this seminar, we will cover M&As between Japanese companies, the slow impact of foreign investment into Japan, and the outward investment strategies of Japanese companies. Speakers: Dr Gerhard Fasol, President, Eurotechnology Japan KK David…