Category: internet

-

NTT Communications reportedly in talks to acquire German data center operator e-shelter facility services GmbH

NTT Communications to continue global expansion e-shelter offers about 90,000 square meters of data center space in 9 locations NTT Communications is reported by Nikkei to be in negotiations to acquire Frankfurt based e-shelter facility services GmbH for approximately YEN 100 billion (US$ 840 million). NTT Communications acquisition is driven by the need to grow…

-

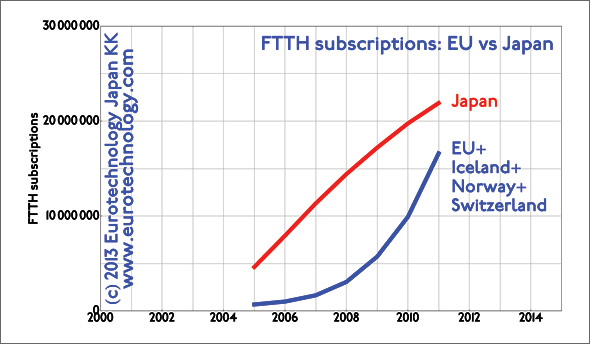

More FTTH broadband in Japan than in all of EU + Norway + Switzerland + Iceland

Japan alone currently has about 30% more FTTH optical fiber broadband subscriptions than all EU countries + Switzerland + Norway + Iceland added together. How much broadband (ADSL, xDSL and FTTH) is installed in Japan? Find the answer and detailed statistics and market shares in our report on Japan’s telecom industry. Similarly, Japan was far…

-

Finland-Japan Ubiquitous Society Conference

October 27, 2006 the Finland-Japan Ubiquitous Society Conference was held in Tokyo. Tero Ojanpera, Exec VP and CTO of NOKIA, gave an overview of NOKIA’s vision of communications, other speakers and panelists included Juho Lipsanen, Finland CEO of TeliaSonera, KDDI Chairman Murakami. The day before I briefed and had a long discussion with the top…

-

Briefing TeliaSonera top management team: “What is the telecom company of the future?”

The day before the Finland-Japan Ubiquitous Society Conference in Tokyo, I briefed the top-management (CEO, CTO and other top managers) of TeliaSonera, on October 26, 2006. The next day, October 27, 2006, the Finland-Japan Ubiquitous Society Conference was held. Tero Ojanpera, Exec VP and CTO of NOKIA, gave an overview of NOKIA’s vision of communications,…

-

EU Government contract awarded: benchmarking broadband/FTTH in EU vs Japan

As a consequence of our CEO’s briefing entitled “Why Japan is several years ahead of Europe in telecommunications and what Europe can do to catch up” on March 23, 2006 for the Technology Attaches of the Embassies of the 25 European Union countries here in Tokyo our company has been awarded a project contract by…

-

Why Japan is several years ahead of EU in telecoms and broadband?

and what can Europe do to catch up? Presentation to EU Technology Attaches at the Embassy of the European Union in Tokyo by Gerhard Fasol by Gerhard Fasol Today (March 23, 2006) I was invited to brief the Technology Attaches of the Embassies of the 25 European Union countries here in Tokyo about Japan’s telecommunications…

-

Cable and Wireless-Japan acquired by Softbank???!!

Today’s top article in Nikkei is about Cable and Wireless-Japan: the article reports that Cable and Wireless is in discussion with Softbank and a private equity firm to sell their Japan operations. Apparently this news article is not confirmed, and it already mentions a purchase prize on the order of US$ 100 million. This article…