Category: IT

-

Supercell: Softbank increases ownership to 73.2%

Supercell valued at US$ 5.3 billion Softbank and GungHo jointly acquired 51% in October 2013 for US$ 1.5 billion by Gerhard Fasol On June 1, 2015, SoftBank announced an investment to increase the ownership of Supercell stock from 50.5% to 73.2% on a fully diluted basis. This transaction had closed on May 29, 2015. While…

-

MixRadio: from Nokia to Microsoft to LINE

Messaging giant LINE continuous globalization MixRadio will complement LINE’s local Japanese LINE Music service by Gerhard Fasol In December 2014, LINE and Microsoft announced that LINE will acquire the streaming music service MixRadio from Microsoft. LINE already operates a Japan-only streaming music service “LINE Music”. Since music licensing is largely country or region specific, with…

-

NTT Communications reportedly in talks to acquire German data center operator e-shelter facility services GmbH

NTT Communications to continue global expansion e-shelter offers about 90,000 square meters of data center space in 9 locations NTT Communications is reported by Nikkei to be in negotiations to acquire Frankfurt based e-shelter facility services GmbH for approximately YEN 100 billion (US$ 840 million). NTT Communications acquisition is driven by the need to grow…

-

Colt to acquire KVH – the Tokyo based cloud and data center service provider

Colt to acquire KVH for YEN 18.595 billion (€ 130.3 million = US$ 160 million) by Gerhard Fasol The acquisition Both Colt and KVH were founded with investments by Fidelity Investments and associated companies, Colt in London in 1992, and KVH in 1999 in Tokyo, as telecommunications service providers for the financial industry and other…

-

Nokia to buy Panasonic’s mobile phone base station division

Nokia to acquire Panasonic System Networks by Gerhard Fasol Nokia to expand market share in Japan, Panasonic to focus on core business Panasonic, after years of weak financial performance, is focusing on core business. Nikkei reports that Panasonic is planning to sell the base station division, Panasonic System Networks, to Nokia. Nokia expands No. 1…

-

![Arkadin’s [enjoy sharing] 91.2% AXA stake to be sold to NTT Communications](https://eu-japan.com/b/wp-content/uploads/2014/12/IMG_7620_ntt_2000.png)

Arkadin’s [enjoy sharing] 91.2% AXA stake to be sold to NTT Communications

Arkadin International SAS valued at approx. US$ 463 million Collaboration-as-a-Service (CaaS) On August 5, 2013, NTT Communications (NTT Com) announced that it will acquire 91.2% of the shares of the French conference and collaboration specialist Arkadin International SAS from current investors AXA Private Equity (now: Ardian Investment) and other investors. The valuation is estimated at…

-

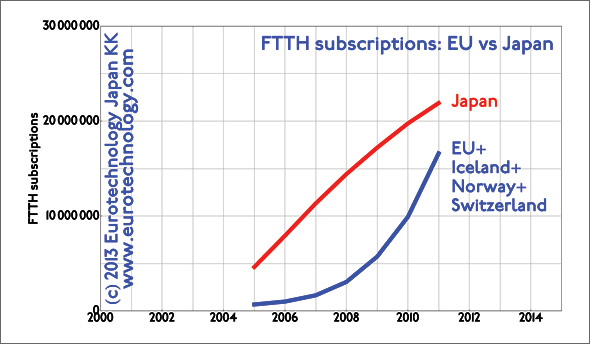

More FTTH broadband in Japan than in all of EU + Norway + Switzerland + Iceland

Japan alone currently has about 30% more FTTH optical fiber broadband subscriptions than all EU countries + Switzerland + Norway + Iceland added together. How much broadband (ADSL, xDSL and FTTH) is installed in Japan? Find the answer and detailed statistics and market shares in our report on Japan’s telecom industry. Similarly, Japan was far…

-

Buongiorno SpA acquired by NTT Docomo for € 209 million (US$ 260 million)

NTT Docomo acquired Italian mobile content, apps and service provider in a public tender offer Buongiorno SpA becomes fully owned subsidiary of NTT Docomo NTT Docomo acquired mobile content provider Buongiorno SpA in August 2012 following a public tender offer via Docomo’s German subsidiary DOCOMO Deutschland GmbH. The shares were delisted from the Italian Stock…

-

NOKIA quits Japan – for now…

NOKIA’s Japan subsidiary was founded on April 3, 1989 – almost 20 years ago. On November 27, 2008 NOKIA announced to terminate selling mobile phones to Japan’s mobile operators, effectively withdrawing from Japan (except for purchasing, R&D and VERTU). NOKIA’s sales figures in Japan were a well kept secret until last week when several Japanese…

-

Nokia & Sony Ericsson Results Likely to Disappoint (CNBC TV interview)

More in our J-ELECTRIC report: http://www.eurotechnology.com/store/j_electric/ Copyright·©2013 ·Eurotechnology Japan KK·All Rights Reserved·

-

"Help – my mobile phone does not work!" – Why Japan’s mobile phone sector is so different from Europe’s

Presentation at the Lunch meeting of the Finnish Chamber of Commerce in Japan (FCCJ) on March 16, 2007 at the Westin Hotel, Tokyo. Find the summary and photos of the meeting here Download the presentation here From the Announcement: In his presentation, Dr. Fasol will explain the essentials of Japan’s mobile phone market, why and…

-

Trends in high technology in Japan (EU mission on foreign direct investment in Japan)

The EU-Japan Center for Industrial Cooperation held a 5-day intensive course in Japan for executives from EU firms between Monday 19th February – Friday 23rd February, 2007 on foreign direct investment in Japan. On Monday 19th February Gerhard Fasol gave a talk “Trends in high technology in Japan”, covering the following points: “Japan is a…

-

Ericsson Strategy & Technology Summit Tokyo

Eurotechnology’s CEO was invited to attend Ericsson’s Strategy & Technology Summit in Tokyo on November 15, 2006. Ericsson’s CEO, Carl-Henric Svanberg, Ericsson CSO – Chief of Strategy, Japan-CEO Rory Buckley and other Ericsson top management presented Ericsson’s strategy and vision. About 100 investors and investment bank analysts were invited to attend. I was given the…

-

Finland-Japan Ubiquitous Society Conference

October 27, 2006 the Finland-Japan Ubiquitous Society Conference was held in Tokyo. Tero Ojanpera, Exec VP and CTO of NOKIA, gave an overview of NOKIA’s vision of communications, other speakers and panelists included Juho Lipsanen, Finland CEO of TeliaSonera, KDDI Chairman Murakami. The day before I briefed and had a long discussion with the top…

-

Briefing TeliaSonera top management team: “What is the telecom company of the future?”

The day before the Finland-Japan Ubiquitous Society Conference in Tokyo, I briefed the top-management (CEO, CTO and other top managers) of TeliaSonera, on October 26, 2006. The next day, October 27, 2006, the Finland-Japan Ubiquitous Society Conference was held. Tero Ojanpera, Exec VP and CTO of NOKIA, gave an overview of NOKIA’s vision of communications,…

-

Briefing EU Technology Attaches to Japan about Japan’s telecom sector – unspoken question: Why did Vodafone fail in Japan?

by Gerhard Fasol Following Vodafone’s decision to end business in Japan and the announcement of the sale of Vodafone-Japan to SoftBank, this author has been asked to brief the Technology Attaches of the 25 EU Embassies in Tokyo on Japan’s mobile phone and telecom sector. The EU Technology Attaches were particularly interested in the impact…

-

Vodafone brand disappears from Japan: Vodafone -> SoftBank rebranding

Vodafone sells Japan operations to Softbank by Gerhard Fasol Vodafone brand is replaced by the Softbank brand “SoftBank” replaces “Vodafone” brand in Japan following Vodafone’s decision to sell all Japan operations to the Softbank Group (after Vodafone had previously split off and sold fixed-line and other operations to Softbank in earlier transactions). Photographs below show…

-

Implementing Vodafone’s departure from Japan: SoftBank starts rebranding Vodafone in Japan

Vodafone sold Japan operations to SoftBank by Gerhard Fasol The Vodafone brand is replaced by the SoftBank brand all over Japan Saturday June 10, 2006 was the first time we saw SoftBank replacing the Vodafone brand in Japan – bringing a formal end to Europe’s largest ever investment in Japan. Vodafone’s withdrawal from Japan is…

-

EU Government contract awarded: benchmarking broadband/FTTH in EU vs Japan

As a consequence of our CEO’s briefing entitled “Why Japan is several years ahead of Europe in telecommunications and what Europe can do to catch up” on March 23, 2006 for the Technology Attaches of the Embassies of the 25 European Union countries here in Tokyo our company has been awarded a project contract by…

-

Why Japan is several years ahead of EU in telecoms and broadband?

and what can Europe do to catch up? Presentation to EU Technology Attaches at the Embassy of the European Union in Tokyo by Gerhard Fasol by Gerhard Fasol Today (March 23, 2006) I was invited to brief the Technology Attaches of the Embassies of the 25 European Union countries here in Tokyo about Japan’s telecommunications…

-

EU investments in Japan: Why did Vodafone fail in Japan?

Vodafone made the largest ever European investment in Japan by Gerhard Fasol Why did Vodafone fail so dramatically in Japan? Quick answer Vodafone failed in Japan not for one single reason but for hundreds of reasons, which can be grouped into two groups Long answer Find a long answer in this blog post below, in…

-

Vodafone in Japan? Why did Vodafone change its mind about Japan?

Negotiations between SoftBank and Vodafone about sale of Vodafone Japan confirmed by Gerhard Fasol Bloomberg: Vodafone-Japan CEO Tsuda seeks growth in Japan, not sale About one year ago, in an interview with Bloomberg (“Vodafone KK’s Tsuda seeks growth in Japan, not sale“), I mentioned that a sale of Vodafone’s Japan operations to Softbank might be…

-

SANYO – NOKIA CDMA2000 JV (Interview for CNBC)

Was interviewed today about the announced JV between SANYO and Nokia for CDMA2000 phone handsets (I added some corrections here): [Q1] How will SANYO benefit from this, since they are the ones who have the technology, what do they hope to gain from working with Nokia? Or is this merely a way to reduce costs…

-

SonyEricsson design team presentation & discussion at the Embassy of Sweden in Tokyo

The SonyEricsson mobile phone design team gave a very impressive presentation of their work at the Swedish Embassy yesterday. Here is Art Director Mr Kawagoi, who created the famous SonyEricsson logo, explaining the messages contained in his creation: Here Swedish Managers of the SonyEricsson Creative Design Center from Lund/Sweden: My conclusion: expect a lot more…

-

Cable and Wireless-Japan acquired by Softbank???!!

Today’s top article in Nikkei is about Cable and Wireless-Japan: the article reports that Cable and Wireless is in discussion with Softbank and a private equity firm to sell their Japan operations. Apparently this news article is not confirmed, and it already mentions a purchase prize on the order of US$ 100 million. This article…

-

The Economist about 3G and Vodafone in Japan

An article in The Economist about Vodafone is partly based on our analysis: “Vodafone- Not so big in Japan” (The Economist, Sept 30th, 2004) Japan telecommunications industry market report Copyright 1997-2013 Eurotechnology Japan KK All Rights Reserved