Category: EU-Japan business

-

Growing your business in Japan (video conference)

Despite being the world’s third largest market, many businesses struggle to break into Japan. The “Growing your Business in Japan” free webinar, organized by the SCI’s Science and Enterprise Group and powered by LabLinks, will provide valuable insights into the challenges of growing a chemistry-facing business in the Japanese market, and how they can be overcome. The host, Dr Alan Steven – Chief…

-

TOSHIBA sells KONE holding for approx. US$ 0.95 billion

Toshiba sells its 4.6% holding in Finnish elevator company KONE by Gerhard Fasol TOSHIBA sells KONE holding – fall-out from Toshiba’s accounting issues TOSHIBA sells KONE holding: In the wake of Toshiba’s accounting issues, Toshiba announced the sale of its 24,186,720 shares, corresponding to a 4.6% holding in Finnish elevator company KONE for EURO 864.7…

-

Sir Stephen Gomersall on UK-Japan relations & globalization

Sir Stephen Gomersall on corporate governance: Board Meetings should be like sparkling water – not like tea Globalization and the art of tea Hitachi – Japan’s most iconic corporation – under the leadership of Chairman & CEO, Hiroaki Nakanishi embarked on the “Smart Transformation Project” to globalize, to face a world where value creation has…

-

Tokyo AIM became the Tokyo PRO market, and London Stock Exchange quits Japan. Here is why!

Tokyo AIM: LSE sells its share in the Tokyo AIM joint venture to Tokyo Stock Exchange and leaves Japan Initially, London Stock Exchange and Tokyo Stock Exchange created Tokyo AIM as a joint-venture company in order to create a jointly owned and jointly managed Tokyo AIM, modeled according to the very successful London AIM model.…

-

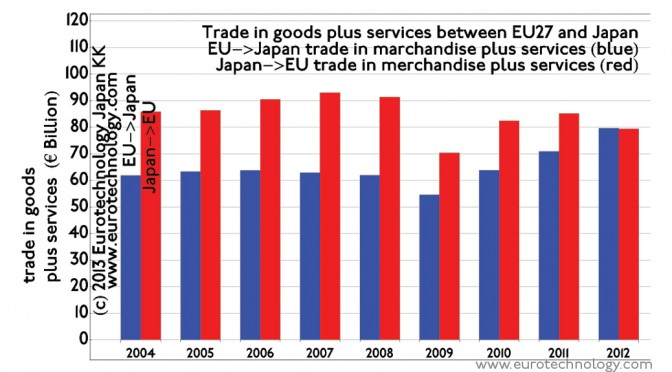

Closing the gap: trade between EU and Japan is now balanced

Combining the amounts of trade for merchandise and commercial services, EU exports to Japan and Japanese exports to EU have reached equal levels, so that the trade between EU and Japan is now balanced around EURO 80 billion in each direction, i.e. a combined trade of EURO 160 billion. Japan is traditionally stronger in the…

-

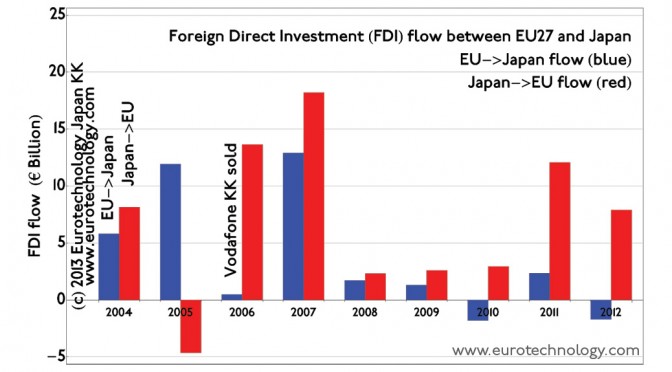

Japan’s direct investments in EU flourish, while EU investments in Japan stagnate

Investment flow between EU and Japan shows strong impact from the Lehmann shock economic downturn. Investment flow from EU to Japan remains at relatively low levels around EURO 1 billion annually, while investments by Japanese companies in the EU are on the order of EURO 10 billion per year currently. M&A and direct investment (FDI)…

-

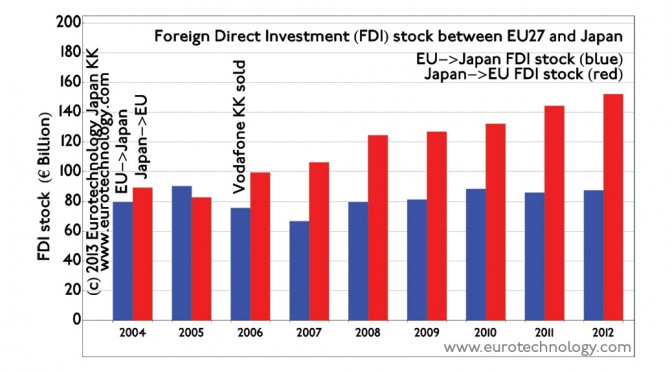

EU Japan investment stock

EU Japan investment stock EU Japan investment: EU to Japan EU to Japan investment register EU investments in Japan have been relatively constant around EURO 80 billion. There has been a marked reduction in EU investment in Japan in 2006 due to the withdrawal of Vodafone from Japan with the sale of Vodafone KK to…

-

Japan energy market: How can an EU company succeed in Japan’s energy landscape? (EU-Japan Gateway keynote)

Japan energy market entry for EU companies EU-Japan Gateway program keynote I was invited to give a keynote talk to about 50 European participants in the EU-Japan Gateway program, which assists small and medium sized European companies to enter the Japanese market. Japan energy market: “How can a European company succeed in Japan’s energy landscape?”…

-

H&M: green field market entry to Japan, opens first Japan store in Tokyo – Ginza on September 13, 2008

H&M entered Japan’s fashion market initially using a green field strategy, opening stores. On September 13, 2008, H&M opened the first store in Japan in Ginza, and is planning two more stores in Shibuya (see picture below) and in Harajuku. H&M adapted it’s global way of doing things to Japan’s market needs – for example,…

-

Trends in high technology in Japan (EU mission on foreign direct investment in Japan)

The EU-Japan Center for Industrial Cooperation held a 5-day intensive course in Japan for executives from EU firms between Monday 19th February – Friday 23rd February, 2007 on foreign direct investment in Japan. On Monday 19th February Gerhard Fasol gave a talk “Trends in high technology in Japan”, covering the following points: “Japan is a…

-

Okaerinasai (=welcome back) IKEA

Today, Monday April 24, 2006 at 7:30am, IKEA invited about 300 guests to celebrate the opening of the first 100% IKEA-owned IKEA store in Japan. We had the honor of working for IKEA – IKEA is another company that “thinks different” in so many creative ways. We wish them all the best in Japan! IKEA…

-

EU investments in Japan: Why did Vodafone fail in Japan?

Vodafone made the largest ever European investment in Japan by Gerhard Fasol Why did Vodafone fail so dramatically in Japan? Quick answer Vodafone failed in Japan not for one single reason but for hundreds of reasons, which can be grouped into two groups Long answer Find a long answer in this blog post below, in…

-

Vodafone in Japan? Why did Vodafone change its mind about Japan?

Negotiations between SoftBank and Vodafone about sale of Vodafone Japan confirmed by Gerhard Fasol Bloomberg: Vodafone-Japan CEO Tsuda seeks growth in Japan, not sale About one year ago, in an interview with Bloomberg (“Vodafone KK’s Tsuda seeks growth in Japan, not sale“), I mentioned that a sale of Vodafone’s Japan operations to Softbank might be…

-

Cable and Wireless-Japan acquired by Softbank???!!

Today’s top article in Nikkei is about Cable and Wireless-Japan: the article reports that Cable and Wireless is in discussion with Softbank and a private equity firm to sell their Japan operations. Apparently this news article is not confirmed, and it already mentions a purchase prize on the order of US$ 100 million. This article…

-

Toshiba Elevator and Building Systems Corporation (TELC) and KONE enter into capital alliance

Toshiba Elevators and Finnish KONE invest in each other by Gerhard Fasol Toshiba Elevators sends one Director to KONE’s Board, and KONE sends two Directors to Toshiba Elevator’s Board On December 20, 2001, Toshiba Elevator and KONE announced, that in March 2002,: TELC will issue new shares and increase its capital, and KONE will acquire…