Category: FDI

-

Dentsu acquires Gleam Futures via Dentsu Aegis Network as a cultural bridge

Dentsu uses London based Dentsu Aegis Network as a cultural bridge to acquire representation of about 40 YouTube stars Dentsu acquires Gleam Futures: invests to acquire 90% ownership Dentsu acquires Gleam Futures, who “develop, monetize & protect” digital-first talent, ie mainly YouTube focused stars. Japanese companies have a dramatically different culture than Western, European or…

-

SoftBank acquires ARM Holdings plc driven by paradigm shift to Internet of Things (IoT)

On 18 July 2016 SoftBank announced to acquire ARM Holdings plc for £17 per share, corresponding to £24.0 billion (US$ 31.4 billion) by Gerhard Fasol SoftBank acquires ARM: acquisition completed on 5 September 2016, following 10 years of “unreciprocated love” for ARM On 18 July 2016 SoftBank announced a “Strategic Agreement”, that SoftBank plans to…

-

Toray acquires Delta-Tech SpA to expand carbon fiber business in Europe

Toray acquires Delta-Tech: 55% of Italian fiber manufacturer Delta-Tech SpA including Delta-Preg SpA Toray management program Project AP-G 2016: “thorough implementation of growth strategy through innovation and aggressive management” Toray acquires Delta-Tech: acquires 55% of outstanding shares of the Italian prepreg manufacturer Delta-Tech SpA including the fully owned subsidiary Delta-Preg SpA. Delta-Tech SpA and Delta-Preg…

-

Suzuki Volkswagen “Wagen-san” divorce: a teachable moment

“Mr. Suzuki didn’t want to be a VW employee, and that’s understandable” (Prof. Dudenhoeffer via Bloomberg) Suzuki Volkswagen divorce: Volkswagen makes approx US$ 1.3 billion profit, Suzuki comes out more or less even by Gerhard Fasol, All Rights Reserved. 18 September 2015, updated: 27 September 2015 A smiling Martin Winterkorn and Osamu Suzuki (79 years…

-

Hitachi Rail Europe Ltd opens £82 million train factory in Newton Aycliffe, County Durham, UK

Hitachi received orders for 866 Intercity Express Program (IEP) carriages and for 234 carriages for Abellio’s ScotRail program, following 174 “Javelin” carriages Hitachi Rail putting competitive pressure on Europe’s rail established rail manufacturers: Hitachi Rail has “on time delivery” at the top of the list of commitments to customers by Gerhard Fasol Winning a series…

-

Financial Times to be sold to Nihon Keizai Shinbun Corporation (株式会社日本経済新聞社, Nikkei Inc.)

Nikkei won the race. Axel Springer withdrew. £ 94 million made the difference. by Gerhard Fasol On July 23, 2015 at 15:13 (3:13 pm) British Summer Time, Pearson and Nihon Keizai Shinbun Corporation announced the sale of the Financial Times Newspaper to Nihon Keizai Shinbun Corporation for £ 844 million (approx. US$ 1.3 billion) –…

-

TOSHIBA sells KONE holding for approx. US$ 0.95 billion

Toshiba sells its 4.6% holding in Finnish elevator company KONE by Gerhard Fasol TOSHIBA sells KONE holding – fall-out from Toshiba’s accounting issues TOSHIBA sells KONE holding: In the wake of Toshiba’s accounting issues, Toshiba announced the sale of its 24,186,720 shares, corresponding to a 4.6% holding in Finnish elevator company KONE for EURO 864.7…

-

Fits.me acquired by Rakuten

Rakuten continues worldwide acquisitions to globalize by Gerhard Fasol acquired London based virtual fitting room mannequin venture Fits.me Rakuten, Japan’s largest e-commerce + e-finance group, is acquiring many companies around the world both to acquire technology, and to acquire e-commerce capabilities outside Japan in order to globalize. Find some of Rakuten’s recent acquisitions in Europe…

-

Nidec acquires automotive pump company Geräte- und Pumpenbau GmbH Dr. Eugen Schmidt

Electrical water pumps (EWP), electrical oil pumps (EOP) “for everything that spins and moves” by Gerhard Fasol Nidec acquires German pump manufacturer Geräte- und Pumpenbau GmbH Dr. Eugen Schmidt via the subsidiary Nidec Motors & Actuators (Germany) GmbH (“NMA(G)”) on February 2, 2015. Geräte- und Pumpenbau GmbH Dr. Eugen Schmidt and subsidiaries have been renamed:…

-

Nidec acquires power generators manufacturer Motortecnica s.r.l.

Nidec continues acquisitions in Europe in the motor and electrical equipment sector Nidec: “for everything that spins and moves” Nidec acquired the Italian electrical machinery construction and repair company Motortecnica s.r.l. on May 15, 2015 via its Italian subsidiary Nidec ASI S.p.A. (formerly, Ansaldo Sistemi Industriali S.p.A), which Nidec had acquired in May 2012. Motortecnica…

-

LIXIL announces losses of YEN 33.2 billion (US$ 265 million) due to Joyou AG’s insolvency filing

LIXIL (“Link to good living”) acquired approx. 70% of German listed Chinese subsidiary Joyou AG via the GROHE acquisition Joyou AG files for bankruptcy On January 21, 2014, LIXIL had acquired 87.5% of the German bath fixtures company GROHE Group (“Pure Freude am Wasser”). The GROHE Group owns 72.3% of Joyou AG, thus Joyou AG…

-

abaGada, Israeli digital performance agency, acquired by Dentsu and to be rebranded as iProspect

Dentsu continues acquisition of digital and mobile agencies in Europe and Israel To overcome cultural issues of a traditional Japanese leading corporation, Dentsu acquires via London based Dentsu Aegis Network by Gerhard Fasol On April 20, 2015 Dentsu announced another investment in its quest to strengthen its global footprint and to strengthen capabilities in mobile…

-

Hitachi agrees with Finmeccanica S.p.A. to acquire rail business of AnsaldoBreda S.p.A. and 40% of rail signaling company Ansaldo STS S.p.A.

AnsaldoBreda rail business to help Hitachi to compete globally with Siemens, Bombardier and Alstom by Gerhard Fasol Finmeccanica accelerates restructuring, reduces debt and focuses on aerospace, defense and security Hitachi Ltd (株式会社 日立製作所) and Finmeccanica S.p.A. announced on February 24, 2015, that their Boards of Directors have agreed for Hitachi to: acquire the rail business…

-

Canon offers SEK 23.6 Billion for CCTV leader Axis AB

Canon aims for leadership in the US$ 15 billion global video surveillance market by Gerhard Fasol Canon offers 50% premium on Axis Aktiebolag share price of Monday Feb 9, 2015 Canon is one of Japan’s most successful electronics groups, with imaging as one of Canon‘s core business areas. On February 10, 2015, Canon launched a…

-

itelligence AG acquired by NTT Data

NTT DATA Business Solutions Largest global SAP reseller and one of the largest SAP solution providers On 23 October 2007, NTT DATA, NTT DATA Europe and itelligence AG announced a partnership, and NTT DATA announced to intention of an offer to acquire the shares at € 6.20 per share, about 37.2% higher than the closing…

-

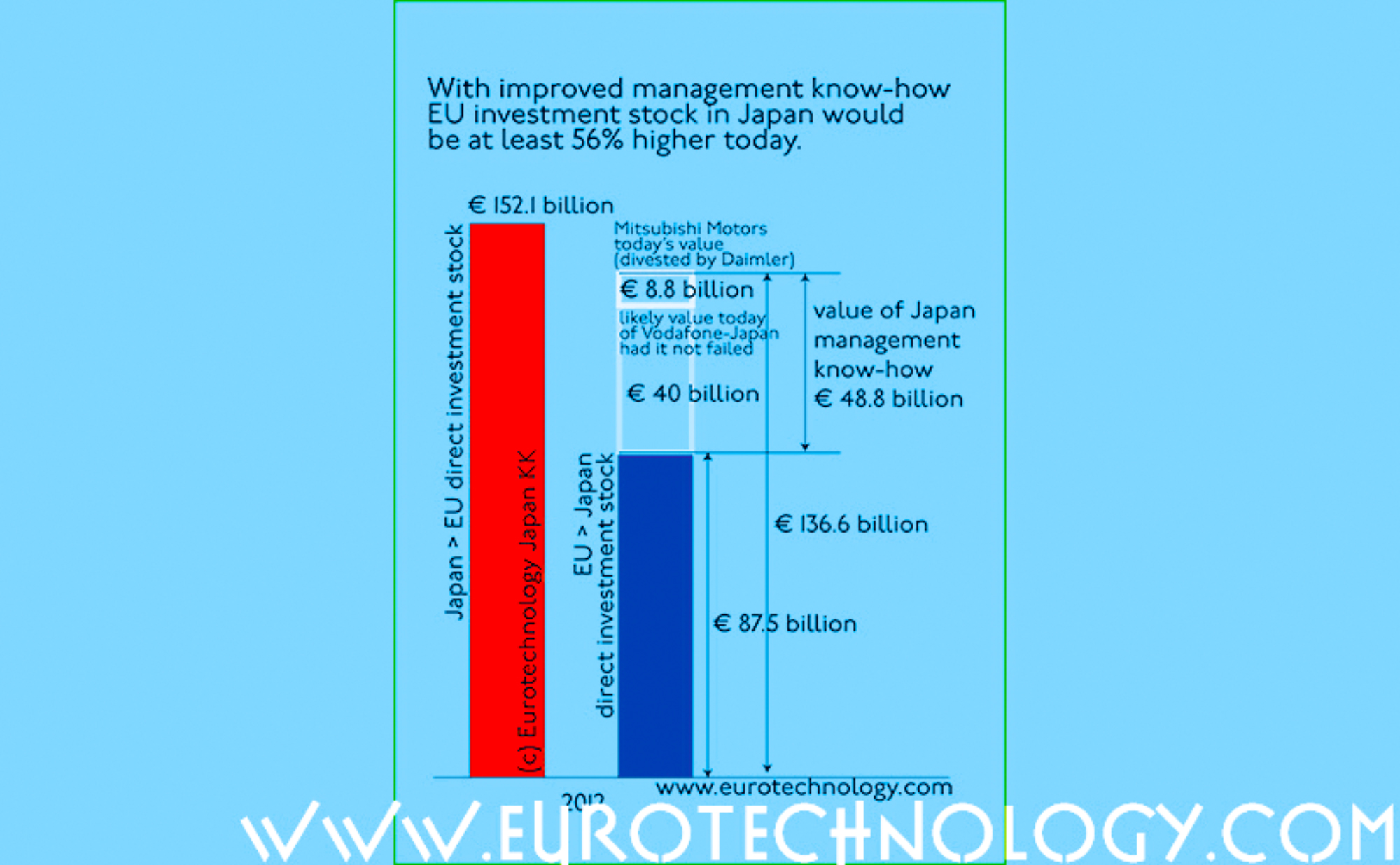

EU investment in Japan could be 50% higher had Vodafone succeeded in Japan

EU investment in Japan is about € 85 billion – it could be 50% higher! by Gerhard Fasol Vodafone-Japan: what could the value be today? Had Vodafone succeeded in Japan, Vodafone-Japan could be worth about US$ 50 billion today, about 1/2 of Vodafone’s total global market-cap today, and combined investment in Japan by European (EU)…

-

Yaskawa acquires The Switch Engineering Oy, manufacturer of generators for wind power

The Switch Engineering Oy was valued US$ 265 million in 2011 Trend: Japanese companies acquire European renewable energy technology companies On July 2, 2014 Yaskawa Electric Corporation acquired all shares of The Switch Engineering Oy, which are not owned by the Switch. The acquisition price was not announced, however, AMSC in 2011 had agreed and…

-

DC Storm acquired by Rakuten Marketing to strengthen marketing analytics and attribution

Rakuten acquires marketing attribution specialist Following acquisition of Adometry by Google and of Convertro by AOL On May 28, 2014, Rakuten Marketing announced the acquisition of the Brighton (UK) based marketing attribution specialist DC Storm. Although terms of the acquisition were not disclosed, Google on May 6, 2014 acquired Adometry for about US$ 150 million,…

-

Tokyo AIM became the Tokyo PRO market, and London Stock Exchange quits Japan. Here is why!

Tokyo AIM: LSE sells its share in the Tokyo AIM joint venture to Tokyo Stock Exchange and leaves Japan Initially, London Stock Exchange and Tokyo Stock Exchange created Tokyo AIM as a joint-venture company in order to create a jointly owned and jointly managed Tokyo AIM, modeled according to the very successful London AIM model.…

-

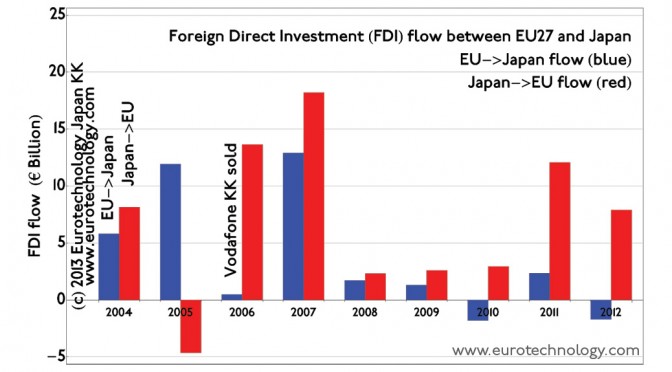

Japan’s direct investments in EU flourish, while EU investments in Japan stagnate

Investment flow between EU and Japan shows strong impact from the Lehmann shock economic downturn. Investment flow from EU to Japan remains at relatively low levels around EURO 1 billion annually, while investments by Japanese companies in the EU are on the order of EURO 10 billion per year currently. M&A and direct investment (FDI)…

-

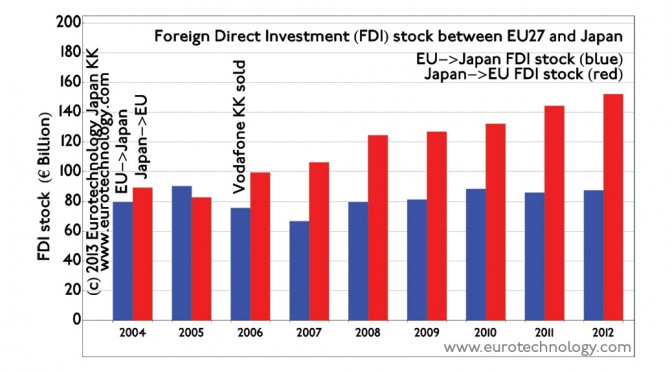

EU Japan investment stock

EU Japan investment stock EU Japan investment: EU to Japan EU to Japan investment register EU investments in Japan have been relatively constant around EURO 80 billion. There has been a marked reduction in EU investment in Japan in 2006 due to the withdrawal of Vodafone from Japan with the sale of Vodafone KK to…

-

Simple Agency srl investment by Japan’s advertising giant Dentsu

by Gerhard Fasol Dentsu further expands the global footprint in Europe Social, content and digital marketing empowerment based in Italy On July 30, 2013 Dentsu announced another European investment this year in its quest to strengthen its global footprint: the acquisition of a 70% majority share in the Italian Simple Agency via Aegis Media Italia,…

-

Hitachi Consulting acquires operations management consulting firm Celerant Consulting at a value of about US$ 145 million

Hitachi Consulting growth is in line with Hitachi’s Smart Transformation Hitachi Consulting aims to grow to US$ 1.5 billion annual revenues by FY2015 by Gerhard Fasol Hitachi Consulting announced on January 2, 2013 the acquisition of the UK based operations management consulting firm Celerant Consulting. Caledonia Investments announced the sale of its 47.3% ownership in…

-

Alpha Direct Services (ADS) acquired by Rakuten to build European logistics

Rakuten builds European logistics infrastructure Rakuten’s 6th acquisition in Europe Rakuten is aggressively globalizing in the face of intense competition by Amazon.com, and more recently Alibaba. As part of global growth, Rakuten is acquiring a string of e-commerce, e-book, online media, and software and service companies in Europe. Now Rakuten has started to build fulfillment…