EU investment in Japan is about € 85 billion – it could be 50% higher!

Vodafone-Japan: what could the value be today?

Had Vodafone succeeded in Japan, Vodafone-Japan could be worth about US$ 50 billion today, about 1/2 of Vodafone’s total global market-cap today, and combined investment in Japan by European (EU) companies could be about 50% higher than it is today!

With COLT about to acquire KVH, it might seem that this is the only foreign infrastructure based telecom provider left in Japan’s telecom market after a long string of management failures, including Vodafone, Cable & Wireless, Willcom, WorldCom and others.

However, foreign investment in Japan’s telco/cloud infrastructure has not ended, and we believe the next wave including AWS, Microsoft, Google et al may become far more successful than the first wave.

For companies considering investment or business expansion in Japan, it is useful to understand the potential market-capitalization which can be achieved in Japan in case of success, instead of just looking at the sales figures:

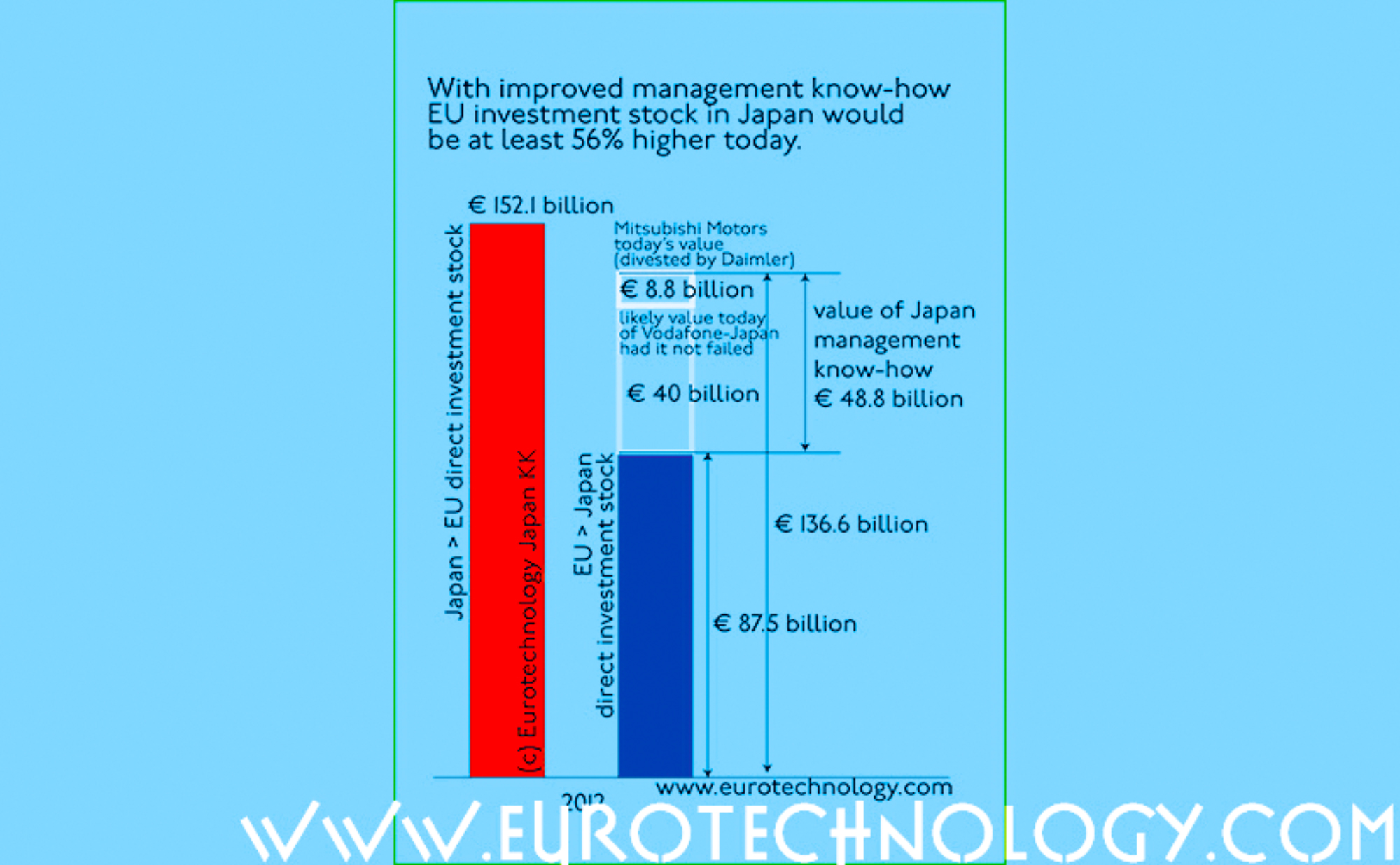

- as an example, combined EU investment in Japan is estimated to be approx. € 85 billion (US$ 106 billion) in total,

- had Vodafone succeeded in Japan, total investment in Japan by European (EU) companies would be about 50% higher than it is today.

Why Vodafone-Japan could be worth US$ 50 billion (1/2 of Vodafone’s global market cap) had it been successful

Let us estimate what Vodafone-Japan could be worth today, had it not failed:

Since Vodafone-Japan’s sale to SoftBank on March 17, 2006, Japan’s telecom market has continuously grown, so we can expect today’s valuations to be considerably higher than in 2006. Lets assume that Vodafone-Japan had been successful, and had grown in sync with competitors NTT-Docomo and KDDI, and lets assume that Vodafone-Japan would have been able to continue J-Phone’s innovations to keep subscription figures and financial results in sync with KDDI. In this case, it would not be unreasonable to assume that Vodafone-Japan’s market capitalization today would be KDDI’s minus the value of KDDI’s global data-center business. Thus we arrive at an estimate, that Vodafone-Japan would have a market-cap value on the order of US$ 50 billion today.

US$ 50 billion is about 50% of Vodafone’s total global valuation, and about 50% of the sum of all direct investments in Japan by all European (EU) companies combined.

Thus, had Vodafone been successful in Japan, EU investments in Japan could be about 50% higher than they are today, and Vodafone’s global market cap could be 50% higher as well.

Market capitalization (Dec 2, 2014):

- NTT Group: US$ 61 billion

- NTT-Docomo: US$ 68 billion

- KDDI: US$ 58 billion

- SoftBank: US$ 80 billion

- Vodafone plc (global group): US$ 97 billion

- Vodafone-Japan market cap, had it been successful (our estimate): US$ 50 billion corresponding to approx. 50% of Vodafone’s global market cap)

- total investment in Japan by all European (EU) companies combined: € 85 billion (= US$ 106 billion)

(see: EU-Japan direct investment register)

Japan telecommunications industry market report

Copyright (c) 2009-2015 Eurotechnology Japan KK All Rights Reserved

Leave a Reply