Tag: vodafone

-

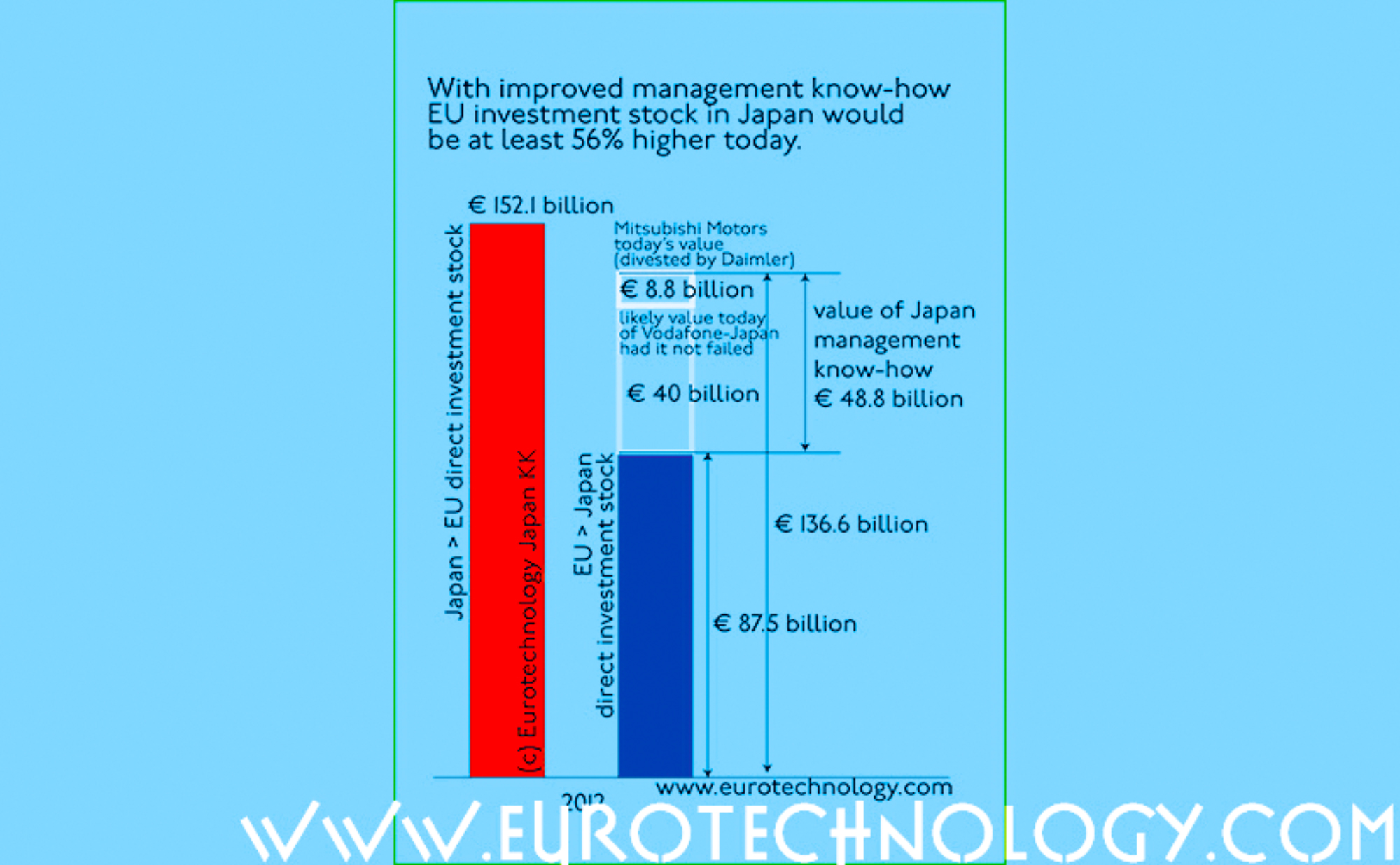

EU investment in Japan could be 50% higher had Vodafone succeeded in Japan

EU investment in Japan is about € 85 billion – it could be 50% higher! by Gerhard Fasol Vodafone-Japan: what could the value be today? Had Vodafone succeeded in Japan, Vodafone-Japan could be worth about US$ 50 billion today, about 1/2 of Vodafone’s total global market-cap today, and combined investment in Japan by European (EU)…

-

Briefing EU Technology Attaches to Japan about Japan’s telecom sector – unspoken question: Why did Vodafone fail in Japan?

by Gerhard Fasol Following Vodafone’s decision to end business in Japan and the announcement of the sale of Vodafone-Japan to SoftBank, this author has been asked to brief the Technology Attaches of the 25 EU Embassies in Tokyo on Japan’s mobile phone and telecom sector. The EU Technology Attaches were particularly interested in the impact…

-

Vodafone brand disappears from Japan: Vodafone -> SoftBank rebranding

Vodafone sells Japan operations to Softbank by Gerhard Fasol Vodafone brand is replaced by the Softbank brand “SoftBank” replaces “Vodafone” brand in Japan following Vodafone’s decision to sell all Japan operations to the Softbank Group (after Vodafone had previously split off and sold fixed-line and other operations to Softbank in earlier transactions). Photographs below show…

-

Implementing Vodafone’s departure from Japan: SoftBank starts rebranding Vodafone in Japan

Vodafone sold Japan operations to SoftBank by Gerhard Fasol The Vodafone brand is replaced by the SoftBank brand all over Japan Saturday June 10, 2006 was the first time we saw SoftBank replacing the Vodafone brand in Japan – bringing a formal end to Europe’s largest ever investment in Japan. Vodafone’s withdrawal from Japan is…

-

Why Japan is several years ahead of EU in telecoms and broadband?

and what can Europe do to catch up? Presentation to EU Technology Attaches at the Embassy of the European Union in Tokyo by Gerhard Fasol by Gerhard Fasol Today (March 23, 2006) I was invited to brief the Technology Attaches of the Embassies of the 25 European Union countries here in Tokyo about Japan’s telecommunications…

-

EU investments in Japan: Why did Vodafone fail in Japan?

Vodafone made the largest ever European investment in Japan by Gerhard Fasol Why did Vodafone fail so dramatically in Japan? Quick answer Vodafone failed in Japan not for one single reason but for hundreds of reasons, which can be grouped into two groups Long answer Find a long answer in this blog post below, in…

-

Vodafone in Japan? Why did Vodafone change its mind about Japan?

Negotiations between SoftBank and Vodafone about sale of Vodafone Japan confirmed by Gerhard Fasol Bloomberg: Vodafone-Japan CEO Tsuda seeks growth in Japan, not sale About one year ago, in an interview with Bloomberg (“Vodafone KK’s Tsuda seeks growth in Japan, not sale“), I mentioned that a sale of Vodafone’s Japan operations to Softbank might be…

-

The Economist about 3G and Vodafone in Japan

An article in The Economist about Vodafone is partly based on our analysis: “Vodafone- Not so big in Japan” (The Economist, Sept 30th, 2004) Japan telecommunications industry market report Copyright 1997-2013 Eurotechnology Japan KK All Rights Reserved