Category: EU investments in Japan

-

Growing your business in Japan (video conference)

Despite being the world’s third largest market, many businesses struggle to break into Japan. The “Growing your Business in Japan” free webinar, organized by the SCI’s Science and Enterprise Group and powered by LabLinks, will provide valuable insights into the challenges of growing a chemistry-facing business in the Japanese market, and how they can be overcome. The host, Dr Alan Steven – Chief…

-

Sanofi acquires SSP (エスエス製薬株式会社) from Boehringer Ingelheim in a global asset swap

Japan’s pharmaceutical market is approx. US$ 80 billion – US$ 120 billion, approx. 10% of the global pharmaceutical market by Gerhard Fasol Sanofi acquires SSP (エスエス製薬株式会社), a Japanese OTC pharmaceutical company, founded as a pharmacy in Tokyo in 1765 Boehringer Ingelheim had acquired SSP (エスエス製薬株式会社), a Japanese OTC pharma company founded originally in 1765 as…

-

Suzuki Volkswagen “Wagen-san” divorce: a teachable moment

“Mr. Suzuki didn’t want to be a VW employee, and that’s understandable” (Prof. Dudenhoeffer via Bloomberg) Suzuki Volkswagen divorce: Volkswagen makes approx US$ 1.3 billion profit, Suzuki comes out more or less even by Gerhard Fasol, All Rights Reserved. 18 September 2015, updated: 27 September 2015 A smiling Martin Winterkorn and Osamu Suzuki (79 years…

-

TOSHIBA sells KONE holding for approx. US$ 0.95 billion

Toshiba sells its 4.6% holding in Finnish elevator company KONE by Gerhard Fasol TOSHIBA sells KONE holding – fall-out from Toshiba’s accounting issues TOSHIBA sells KONE holding: In the wake of Toshiba’s accounting issues, Toshiba announced the sale of its 24,186,720 shares, corresponding to a 4.6% holding in Finnish elevator company KONE for EURO 864.7…

-

Idemitsu Kosan may acquire Showa Shell Sekiyu KK for YEN 500 billion (US$ 4.1 billion)

SHELL may exit Japan after 138 years here Idemitsu Kosan (出光興産株式会社) aims for market leadership On December 20, 2014, both Idemitsu Kosan and Showa Shell separately announced that they had entered into discussions of possible business reorganization, indicating that Idemitsu Kosan may acquire Showa Shell next year. Because Showa Shell Sekiyu KK is a Japanese…

-

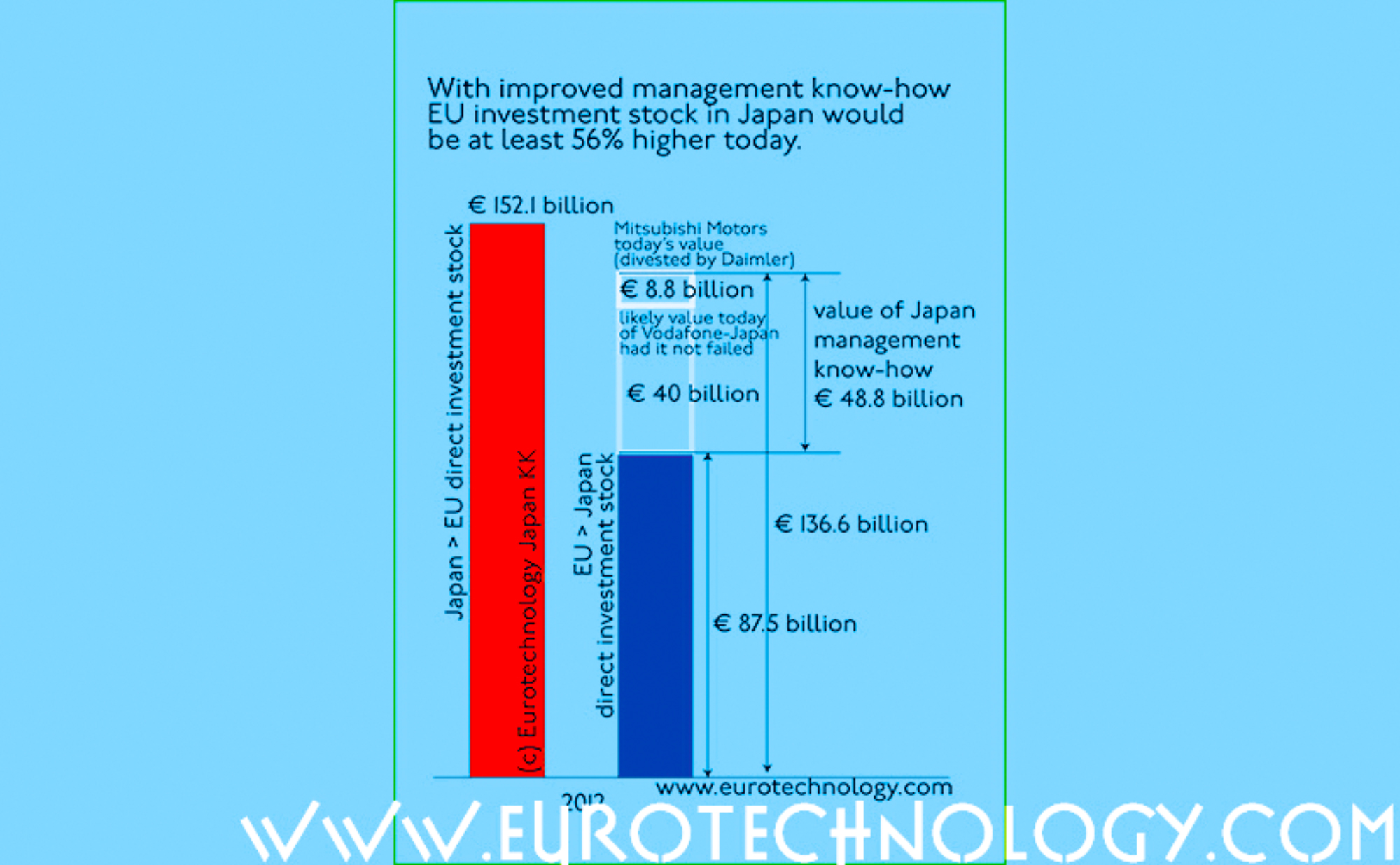

EU investment in Japan could be 50% higher had Vodafone succeeded in Japan

EU investment in Japan is about € 85 billion – it could be 50% higher! by Gerhard Fasol Vodafone-Japan: what could the value be today? Had Vodafone succeeded in Japan, Vodafone-Japan could be worth about US$ 50 billion today, about 1/2 of Vodafone’s total global market-cap today, and combined investment in Japan by European (EU)…

-

Colt to acquire KVH – the Tokyo based cloud and data center service provider

Colt to acquire KVH for YEN 18.595 billion (€ 130.3 million = US$ 160 million) by Gerhard Fasol The acquisition Both Colt and KVH were founded with investments by Fidelity Investments and associated companies, Colt in London in 1992, and KVH in 1999 in Tokyo, as telecommunications service providers for the financial industry and other…

-

Nokia to buy Panasonic’s mobile phone base station division

Nokia to acquire Panasonic System Networks by Gerhard Fasol Nokia to expand market share in Japan, Panasonic to focus on core business Panasonic, after years of weak financial performance, is focusing on core business. Nikkei reports that Panasonic is planning to sell the base station division, Panasonic System Networks, to Nokia. Nokia expands No. 1…

-

Tokyo AIM became the Tokyo PRO market, and London Stock Exchange quits Japan. Here is why!

Tokyo AIM: LSE sells its share in the Tokyo AIM joint venture to Tokyo Stock Exchange and leaves Japan Initially, London Stock Exchange and Tokyo Stock Exchange created Tokyo AIM as a joint-venture company in order to create a jointly owned and jointly managed Tokyo AIM, modeled according to the very successful London AIM model.…

-

Boehringer Ingelheim acquires SSP (エスエス製薬), acquiring remaining 40% for US$ 365 million

Boehringer Ingelheim acquisition values SSP at approx US$ 900 million Boehringer Ingelheim acquires SSP stage-by-stage: 9.2% in 1996, 60% in 2001, 100% in 2010 Boehringer Ingelheim acquires SSP (エスエス製薬株式会社), a Japanese OTC pharma company founded originally in 1765 as a pharmacy in Yaesu, Tokyo, starting with business cooperation, followed by staged investment over a period…

-

Yamaha Motors and Mitsui Group establish Yamaha Motor Middle Europe B.V. (YMME)

Yamaha Motor Middle Europe B.V. (YMME) Foundation 28 November 2007 Start of business 1 January 2008 €18,000 (¥2.9 million) Capital ratio: 60% Yamaha Motor Europe N.V. (wholly owned by Yamaha Motor Co. Ltd) 40% Mitsui Automotive Europe B.V. (wholly owned by Mitsui & Co Ltd) Sales € 450 million (estimate for FY2008) Number of employees…

-

Toshiba Elevator and Building Systems Corporation (TELC) and KONE enter into capital alliance

Toshiba Elevators and Finnish KONE invest in each other by Gerhard Fasol Toshiba Elevators sends one Director to KONE’s Board, and KONE sends two Directors to Toshiba Elevator’s Board On December 20, 2001, Toshiba Elevator and KONE announced, that in March 2002,: TELC will issue new shares and increase its capital, and KONE will acquire…