Tag: FDI

-

Japan’s direct investments in EU flourish, while EU investments in Japan stagnate

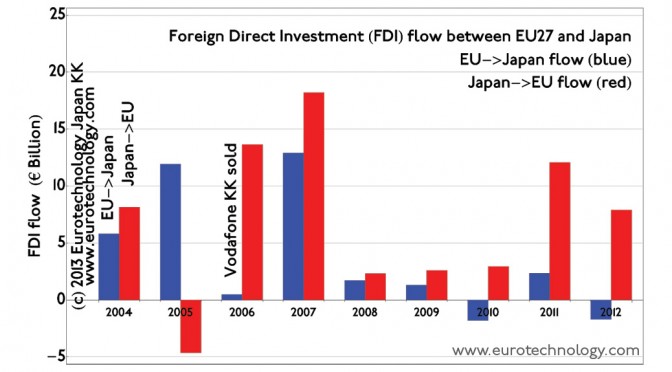

Investment flow between EU and Japan shows strong impact from the Lehmann shock economic downturn. Investment flow from EU to Japan remains at relatively low levels around EURO 1 billion annually, while investments by Japanese companies in the EU are on the order of EURO 10 billion per year currently. M&A and direct investment (FDI)…

-

EU Japan investment stock

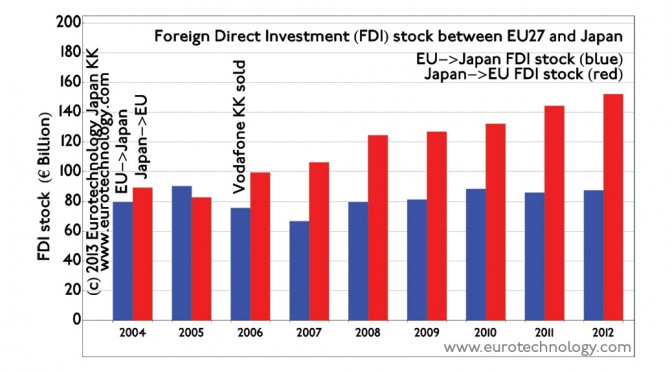

EU Japan investment stock EU Japan investment: EU to Japan EU to Japan investment register EU investments in Japan have been relatively constant around EURO 80 billion. There has been a marked reduction in EU investment in Japan in 2006 due to the withdrawal of Vodafone from Japan with the sale of Vodafone KK to…

-

Trends in high technology in Japan (EU mission on foreign direct investment in Japan)

The EU-Japan Center for Industrial Cooperation held a 5-day intensive course in Japan for executives from EU firms between Monday 19th February – Friday 23rd February, 2007 on foreign direct investment in Japan. On Monday 19th February Gerhard Fasol gave a talk “Trends in high technology in Japan”, covering the following points: “Japan is a…