Category: M&A

-

Canon offers SEK 23.6 Billion for CCTV leader Axis AB

Canon aims for leadership in the US$ 15 billion global video surveillance market by Gerhard Fasol Canon offers 50% premium on Axis Aktiebolag share price of Monday Feb 9, 2015 Canon is one of Japan’s most successful electronics groups, with imaging as one of Canon‘s core business areas. On February 10, 2015, Canon launched a…

-

itelligence AG acquired by NTT Data

NTT DATA Business Solutions Largest global SAP reseller and one of the largest SAP solution providers On 23 October 2007, NTT DATA, NTT DATA Europe and itelligence AG announced a partnership, and NTT DATA announced to intention of an offer to acquire the shares at € 6.20 per share, about 37.2% higher than the closing…

-

Integralis acquired by NTT Communications creating NTT Com Security AG

NTT Communications acquired 78.4% of Integralis AG which is renamed NTT Com Security AG by Gerhard Fasol Managed Security Services (MSS): Greschitz IT Security and Secode AB join NTT Com Security AG On June 30, 2009, NTT Communications announced a public tender offer for the shares of Integralis AG offering € 6.75 in cash per…

-

net mobile AG majority stake acquired by NTT Docomo

globalizing Docomo’s mobile payment and content services bringing German mobile know-how to Japan On September 11, 2009, NTT Docomo announced a voluntary public tender offer for shares of net mobile AG. The tender offer was closed on November 27, 2009, and Docomo Deutschland GmbH acquired 6,126,567 shares at € 6.35 per share corresponding to 79.59%…

-

Idemitsu Kosan may acquire Showa Shell Sekiyu KK for YEN 500 billion (US$ 4.1 billion)

SHELL may exit Japan after 138 years here Idemitsu Kosan (出光興産株式会社) aims for market leadership On December 20, 2014, both Idemitsu Kosan and Showa Shell separately announced that they had entered into discussions of possible business reorganization, indicating that Idemitsu Kosan may acquire Showa Shell next year. Because Showa Shell Sekiyu KK is a Japanese…

-

Toray acquires Saati SpA’s European carbon fiber fabric and prepreg business

Toray acquires Saati’s European fabric business: Toray builds integrated supply chain in Europe Toray management program Project AP-G 2016: “thorough implementation of growth strategy through innovation and aggressive management” Toray acquires Saati’s European fabric business: Toray announced on 10 December 2014 the agreement to acquire the European carbon fiber fabric and prepreg business of Saati…

-

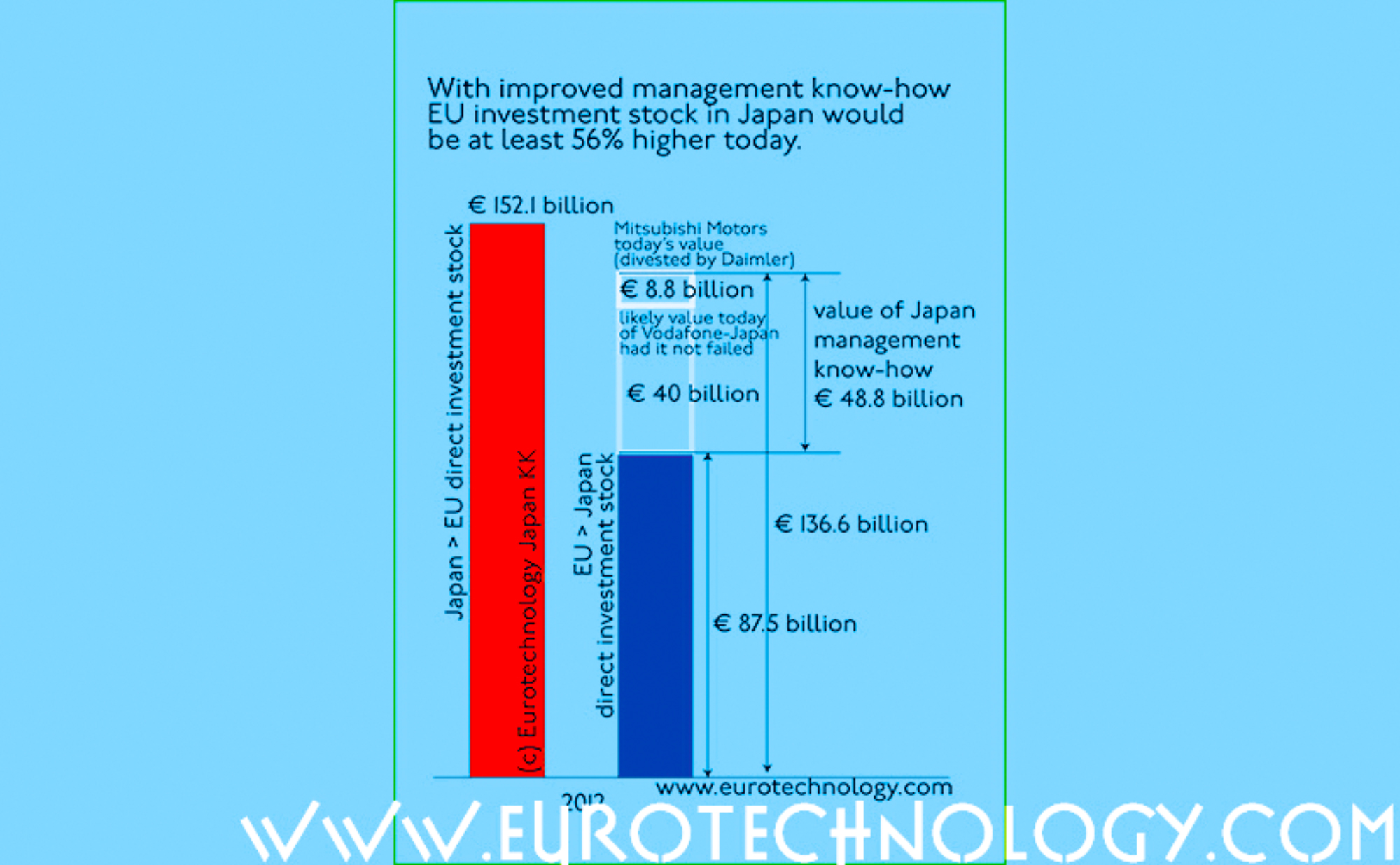

EU investment in Japan could be 50% higher had Vodafone succeeded in Japan

EU investment in Japan is about € 85 billion – it could be 50% higher! by Gerhard Fasol Vodafone-Japan: what could the value be today? Had Vodafone succeeded in Japan, Vodafone-Japan could be worth about US$ 50 billion today, about 1/2 of Vodafone’s total global market-cap today, and combined investment in Japan by European (EU)…

-

Colt to acquire KVH – the Tokyo based cloud and data center service provider

Colt to acquire KVH for YEN 18.595 billion (€ 130.3 million = US$ 160 million) by Gerhard Fasol The acquisition Both Colt and KVH were founded with investments by Fidelity Investments and associated companies, Colt in London in 1992, and KVH in 1999 in Tokyo, as telecommunications service providers for the financial industry and other…

-

Hitachi Zosen Inova AG acquires Energy-from-Waste (EfW) EPC Axpo Kompogas Engineering AG (Komeng)

Waste is our Energy! – Energy-from-Waste (EfW) by Gerhard Fasol Hitachi Zosen Inova AG acquires Axpo Kompogas Engineering AG AXPO agreed on October 24, 2014 to sell its subsidiary Axpo Kompogas Engineering AG to Hitachi Zosen Inova AG (ZHI AG). Closing is in mid December 2014. Axpo Kompogas Engineering AG (Komeng) Axpo Kompogas Engineering AG…

-

JFE Engineering acquires boiler maker Standardkessel Power Systems Holding GmbH

JFE Engineering globalizes and strengthens biomass and waste electricity generation systems business Standardkessel-Baumgarte: from a classic boiler maker to biomass and waste-to-energy power plants JFE Engineering acquires all outstanding shares of Standardkessel Power Systems Holding GmbH, for approximately YEN 10 billion (US$ 87 million), from current shareholders. Standardkessel (founded 1925) and Baumgarte (founded 1935) started…

-

Heraeus Kulzer acquires EGS Srl (Enhanced Geometry Solutions)

Japanese companies’ strategy to overcome cultural post-merger problems: European subsidiaries acquire Heraeus Kulzer acquires EGS, expanding both Mitsui Chemicals’ foot print in Europe and global market penetration for Mitsui Chemicals’ dental supplies business Japanese companies are well known to have substantial difficulties with post merger integration as a consequence of massive cultural differences which need…

-

Panasonic self-driving car technology: Ficosa investment

Panasonic restructures away from TVs and other commodities to automotive parts by Gerhard Fasol Panasonic self-driving car technology As part of the restructuring efforts, Panasonic invests in Spanish car parts maker Ficosa in order to jointly develop Panasonic self-driving car technology. We have documented in our blogs and reports on Japan’s electronics industry how Japan’s…

-

Nippon Steel & Sumikin Engineering Co., Ltd. acquires Fisia Babcock Environment GmbH

Nippon Steel & Sumikin Engineering Co Ltd (Nippon Steel & Sumitomo Metal Corporation, Tokyo Stock Exchange Code 5401) on May 7, 2004 acquired 100% of the shares of Fisia Babcock Environment GmbH (located in Gummersbach, Germany) from Impregilo International Infrastructure N. V. (which is wholly owned by Salini Impregilo S.p.A., Milano, Italy), for EURO 139.3…

-

Video surveillance specialist Milestone Systems A/S acquired by Canon

Canon acquires video surveillance specialist Milestone Systems A/S in June 2014 Milestone Systems A/S is a leading IP based video management software (VMS) and network video recorder (NVR) provider for video surveillance Milestone System was founded in 1998 to apply IP technology from the financial sector to the surveillance video sector, which had previously been…

-

DC Storm acquired by Rakuten Marketing to strengthen marketing analytics and attribution

Rakuten acquires marketing attribution specialist Following acquisition of Adometry by Google and of Convertro by AOL On May 28, 2014, Rakuten Marketing announced the acquisition of the Brighton (UK) based marketing attribution specialist DC Storm. Although terms of the acquisition were not disclosed, Google on May 6, 2014 acquired Adometry for about US$ 150 million,…

-

Hitachi Engineering Europe formed by acquisition of Valcom S.r.l.

Hitachi acquires Valcom, electrical and instrumentation engineering for oil and gas plant systems by Gerhard Fasol Hitachi Engineering Europe: the new name for Valcom Hitachi acquired all outstanding shares of Valcom S.r.l. and will rename the company “Hitachi Engineering Europe S.r.l.” Valcom S.r.l. is an Engineering, Procurement, Construction (EPC) company, headquartered in Milano (Italy), in…

-

Tokyo AIM became the Tokyo PRO market, and London Stock Exchange quits Japan. Here is why!

Tokyo AIM: LSE sells its share in the Tokyo AIM joint venture to Tokyo Stock Exchange and leaves Japan Initially, London Stock Exchange and Tokyo Stock Exchange created Tokyo AIM as a joint-venture company in order to create a jointly owned and jointly managed Tokyo AIM, modeled according to the very successful London AIM model.…

-

LIXIL and Development Bank of Japan (DBJ) together acquire 87.5% of GROHE Group

LIXIL (“Link to Good Living”) pursues strategy to become global leader in building materials and housing equipment industry LIXIL acquires 87.5% of German GROHE Group (“Pure Freude an Wasser”), valuing GROHE at € 3.06 billion Lixil Corporation follows the strategy to become the global leader in building materials and housing equipment, and on January 21,…

-

Japanese insurance SOMPO acquires UK reinsurer Canopius Group Ltd

Japanese insurance SOMPO part of NKSJ Holdings acquires UK reinsurer Canopius Group from Bregal Capital In order to globalize, Japanese insurance company Sompo Japan (株式会社損害保険ジャパン), part of the insurance group NKSJ Holdings (NKSJホールディングス株式会社, TSE / JPX: No. 8630) announced yesterday the acquisition of 100% of the UK re-insurer Canopius Group Limited, operating on Lloyd’s for…

-

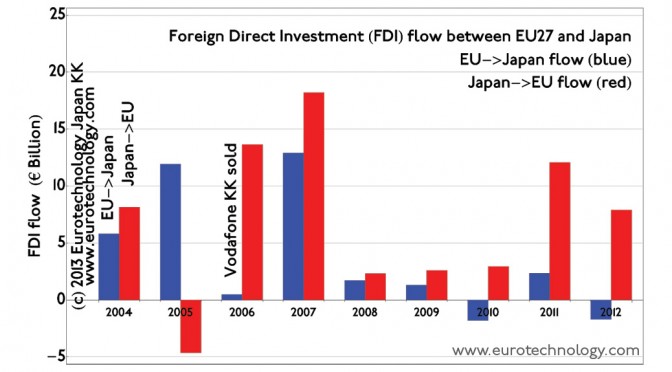

Japan’s direct investments in EU flourish, while EU investments in Japan stagnate

Investment flow between EU and Japan shows strong impact from the Lehmann shock economic downturn. Investment flow from EU to Japan remains at relatively low levels around EURO 1 billion annually, while investments by Japanese companies in the EU are on the order of EURO 10 billion per year currently. M&A and direct investment (FDI)…

-

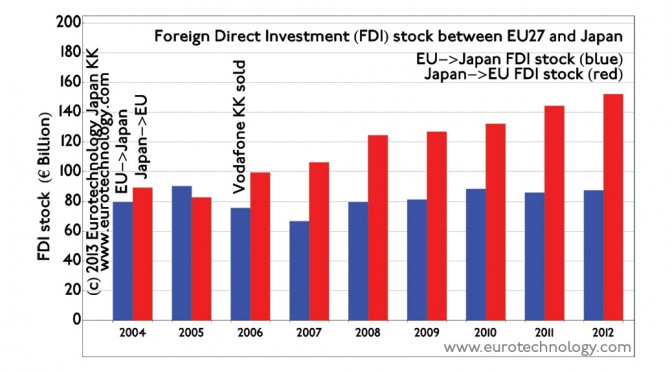

EU Japan investment stock

EU Japan investment stock EU Japan investment: EU to Japan EU to Japan investment register EU investments in Japan have been relatively constant around EURO 80 billion. There has been a marked reduction in EU investment in Japan in 2006 due to the withdrawal of Vodafone from Japan with the sale of Vodafone KK to…

-

Supercell: SoftBank and GungHo acquire 51% for US$ 1.5 billion

Supercell valued at approx. US$ 3 billion Supercell investment leverages paradigm shift, time shift and market disconnects Smartphones and the “freemium” business models are bringing a dual paradigm shift to games and create a new truly global market. To take advantage of this global paradigm shift, its necessary to overcome the cultural disconnects between markets.…

-

Otsuka buys Astex Pharmaceuticals (NASDAQ:ASTX) for US$ 886 million

Astex Pharmaceuticals is an oncology drug discovery company based on the Pyramid drug discovery platform in Cambridge (UK) Otsuka buys Astex in a tender offer for US$ 886 million Otsuka buys Astex Pharmaceuticals (formally Astex Therapeutics, UK). Astex Therapeutics is a oncology drug discovery company based in Cambridge, England, and at the time of acquisition…

-

Ymedia SL and Wink TTD SL investments by Dentsu in Spain

by Gerhard Fasol Dentsu further expands the global footprint in Spain On September 20, 2013 Dentsu announced further European investments this year in its quest to strengthen its global footprint: acquisition of 51% of Ymedia SL via Aegis Media Iberia, full 100% acquisition expected by 2019 acquisition of 31.8% of Wink TTD SL via Aegis…

-

![Arkadin’s [enjoy sharing] 91.2% AXA stake to be sold to NTT Communications](https://eu-japan.com/b/wp-content/uploads/2014/12/IMG_7620_ntt_2000.png)

Arkadin’s [enjoy sharing] 91.2% AXA stake to be sold to NTT Communications

Arkadin International SAS valued at approx. US$ 463 million Collaboration-as-a-Service (CaaS) On August 5, 2013, NTT Communications (NTT Com) announced that it will acquire 91.2% of the shares of the French conference and collaboration specialist Arkadin International SAS from current investors AXA Private Equity (now: Ardian Investment) and other investors. The valuation is estimated at…

-

Simple Agency srl investment by Japan’s advertising giant Dentsu

by Gerhard Fasol Dentsu further expands the global footprint in Europe Social, content and digital marketing empowerment based in Italy On July 30, 2013 Dentsu announced another European investment this year in its quest to strengthen its global footprint: the acquisition of a 70% majority share in the Italian Simple Agency via Aegis Media Italia,…