Author: g_fasol

-

DC Storm acquired by Rakuten Marketing to strengthen marketing analytics and attribution

Rakuten acquires marketing attribution specialist Following acquisition of Adometry by Google and of Convertro by AOL On May 28, 2014, Rakuten Marketing announced the acquisition of the Brighton (UK) based marketing attribution specialist DC Storm. Although terms of the acquisition were not disclosed, Google on May 6, 2014 acquired Adometry for about US$ 150 million,…

-

Horizon2020 Japan conference at the EU Delegation in Tokyo

Horizon 2020 Japan conference encourages Japan participation in this R&D and innovation program of the EU Horizon 2020 Japan: Ambassador Hans Dietmar Schweisgut, welcome Horizon 2020 Japan – Yoichiro Matsumoto: Japan’s research needs to go global (Professor Yoichiro Matsumoto, Executive Vice President, The University of Tokyo) Recent situation in Japanese Universities Japan has shown a…

-

Hitachi Engineering Europe formed by acquisition of Valcom S.r.l.

Hitachi acquires Valcom, electrical and instrumentation engineering for oil and gas plant systems by Gerhard Fasol Hitachi Engineering Europe: the new name for Valcom Hitachi acquired all outstanding shares of Valcom S.r.l. and will rename the company “Hitachi Engineering Europe S.r.l.” Valcom S.r.l. is an Engineering, Procurement, Construction (EPC) company, headquartered in Milano (Italy), in…

-

Tokyo AIM became the Tokyo PRO market, and London Stock Exchange quits Japan. Here is why!

Tokyo AIM: LSE sells its share in the Tokyo AIM joint venture to Tokyo Stock Exchange and leaves Japan Initially, London Stock Exchange and Tokyo Stock Exchange created Tokyo AIM as a joint-venture company in order to create a jointly owned and jointly managed Tokyo AIM, modeled according to the very successful London AIM model.…

-

explido acquired by Dentsu and to be integrated into Dentsu’s iProspect brand

Dentsu acquires German performance and search agency explido explido to be integrated by Dentsu into iProspect brand by Gerhard Fasol On February 28, 2014 Dentsu announced further European investments in its quest to strengthen its global footprint: Dentsu acquires German performance and search agency explido and integrates explido into Dentsu’s iProspect business and brand. explido…

-

LIXIL and Development Bank of Japan (DBJ) together acquire 87.5% of GROHE Group

LIXIL (“Link to Good Living”) pursues strategy to become global leader in building materials and housing equipment industry LIXIL acquires 87.5% of German GROHE Group (“Pure Freude an Wasser”), valuing GROHE at € 3.06 billion Lixil Corporation follows the strategy to become the global leader in building materials and housing equipment, and on January 21,…

-

Toshiba acquires 50% of nuclear power generator NuGeneration

Toshiba acquires 50% of NuGeneration for UKL 85 million by Gerhard Fasol NuGeneration acquires 50% stake in NuGeneration from Spain’s Iberdola In December 2013, Toshiba purchased 50% of NuGeneration Ltd from Iberdrola (of Spain) for UKL 85 million (US$ 146 million), making NuGeneration a 50%/50% joint venture between Toshiba and GDF Suez. NuGeneration Ltd (NuGen)…

-

Japanese insurance SOMPO acquires UK reinsurer Canopius Group Ltd

Japanese insurance SOMPO part of NKSJ Holdings acquires UK reinsurer Canopius Group from Bregal Capital In order to globalize, Japanese insurance company Sompo Japan (株式会社損害保険ジャパン), part of the insurance group NKSJ Holdings (NKSJホールディングス株式会社, TSE / JPX: No. 8630) announced yesterday the acquisition of 100% of the UK re-insurer Canopius Group Limited, operating on Lloyd’s for…

-

Closing the gap: trade between EU and Japan is now balanced

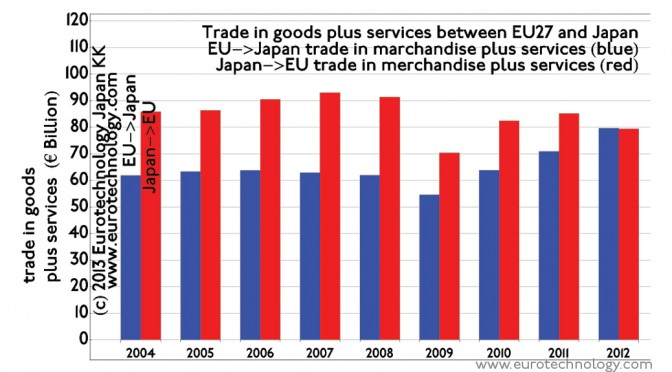

Combining the amounts of trade for merchandise and commercial services, EU exports to Japan and Japanese exports to EU have reached equal levels, so that the trade between EU and Japan is now balanced around EURO 80 billion in each direction, i.e. a combined trade of EURO 160 billion. Japan is traditionally stronger in the…

-

Japan’s direct investments in EU flourish, while EU investments in Japan stagnate

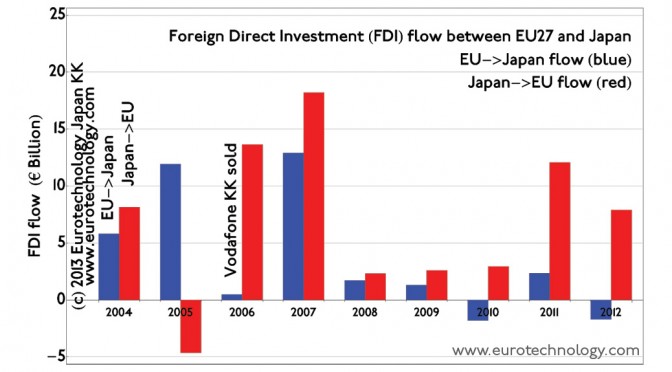

Investment flow between EU and Japan shows strong impact from the Lehmann shock economic downturn. Investment flow from EU to Japan remains at relatively low levels around EURO 1 billion annually, while investments by Japanese companies in the EU are on the order of EURO 10 billion per year currently. M&A and direct investment (FDI)…

-

EU Japan investment stock

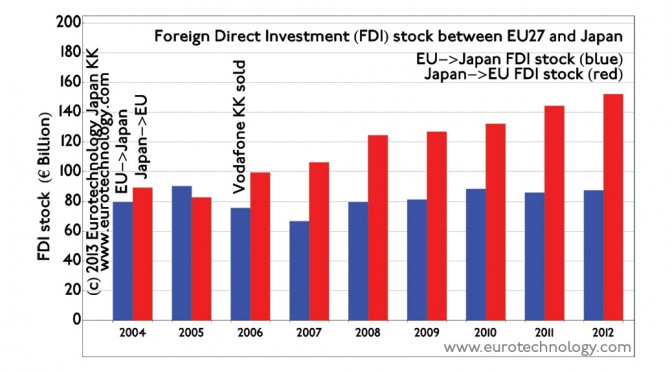

EU Japan investment stock EU Japan investment: EU to Japan EU to Japan investment register EU investments in Japan have been relatively constant around EURO 80 billion. There has been a marked reduction in EU investment in Japan in 2006 due to the withdrawal of Vodafone from Japan with the sale of Vodafone KK to…

-

Supercell: SoftBank and GungHo acquire 51% for US$ 1.5 billion

Supercell valued at approx. US$ 3 billion Supercell investment leverages paradigm shift, time shift and market disconnects Smartphones and the “freemium” business models are bringing a dual paradigm shift to games and create a new truly global market. To take advantage of this global paradigm shift, its necessary to overcome the cultural disconnects between markets.…

-

Otsuka buys Astex Pharmaceuticals (NASDAQ:ASTX) for US$ 886 million

Astex Pharmaceuticals is an oncology drug discovery company based on the Pyramid drug discovery platform in Cambridge (UK) Otsuka buys Astex in a tender offer for US$ 886 million Otsuka buys Astex Pharmaceuticals (formally Astex Therapeutics, UK). Astex Therapeutics is a oncology drug discovery company based in Cambridge, England, and at the time of acquisition…

-

Ymedia SL and Wink TTD SL investments by Dentsu in Spain

by Gerhard Fasol Dentsu further expands the global footprint in Spain On September 20, 2013 Dentsu announced further European investments this year in its quest to strengthen its global footprint: acquisition of 51% of Ymedia SL via Aegis Media Iberia, full 100% acquisition expected by 2019 acquisition of 31.8% of Wink TTD SL via Aegis…

-

fine trade gmbh acquired by NTT Docomo

NTT Docomo expands e-commerce trading solutions platform On August 27, 2013 NTT Docomo announced the planned acquisition of the Austrian company fine trade gmbh, which offers payment solutions to e-commerce and m-commerce companies. The acquisition price has been reported to be “several tens of millions of EUROs”. Docomo acquired via Docomo’s German subsidiary DOCOMO Deutschland…

-

![Arkadin’s [enjoy sharing] 91.2% AXA stake to be sold to NTT Communications](https://eu-japan.com/b/wp-content/uploads/2014/12/IMG_7620_ntt_2000.png)

Arkadin’s [enjoy sharing] 91.2% AXA stake to be sold to NTT Communications

Arkadin International SAS valued at approx. US$ 463 million Collaboration-as-a-Service (CaaS) On August 5, 2013, NTT Communications (NTT Com) announced that it will acquire 91.2% of the shares of the French conference and collaboration specialist Arkadin International SAS from current investors AXA Private Equity (now: Ardian Investment) and other investors. The valuation is estimated at…

-

Simple Agency srl investment by Japan’s advertising giant Dentsu

by Gerhard Fasol Dentsu further expands the global footprint in Europe Social, content and digital marketing empowerment based in Italy On July 30, 2013 Dentsu announced another European investment this year in its quest to strengthen its global footprint: the acquisition of a 70% majority share in the Italian Simple Agency via Aegis Media Italia,…

-

More FTTH broadband in Japan than in all of EU + Norway + Switzerland + Iceland

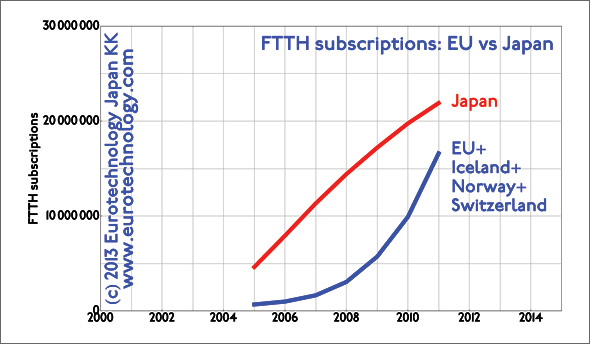

Japan alone currently has about 30% more FTTH optical fiber broadband subscriptions than all EU countries + Switzerland + Norway + Iceland added together. How much broadband (ADSL, xDSL and FTTH) is installed in Japan? Find the answer and detailed statistics and market shares in our report on Japan’s telecom industry. Similarly, Japan was far…

-

Panasonic Automotive acquires AUPEO! – streaming music into internet connected cars

Panasonic continues to restructure away from commodities Panasonic Automotive acquires AUPEO! to stream music into internet connected cars Japan’s electronics giants are under immense pressure to refocus away from commodities. Panasonic Automotive now acquires the German company AUPEO!, specialized on streaming music into internet connected cars. Aupeo was founded in Berlin’s startup scene in 2008…

-

Mitsui Chemicals acquires Heraeus Kulzer GmbH, dental materials for € 450 million

Heraeus divests Heraeus Kulzer GmbH because the use of precious materials for dental restoration is declining Mitsui Chemicals [4183] acquires Heraeus Kulzer GmbH to combine with Sun Medical Co Ltd to form a global dental materials business At the Board Meeting of April 4, 2013 Mitsui Chemicals Inc decided to acquire the dental business of…

-

Japan energy market: How can an EU company succeed in Japan’s energy landscape? (EU-Japan Gateway keynote)

Japan energy market entry for EU companies EU-Japan Gateway program keynote I was invited to give a keynote talk to about 50 European participants in the EU-Japan Gateway program, which assists small and medium sized European companies to enter the Japanese market. Japan energy market: “How can a European company succeed in Japan’s energy landscape?”…

-

Hitachi Consulting acquires operations management consulting firm Celerant Consulting at a value of about US$ 145 million

Hitachi Consulting growth is in line with Hitachi’s Smart Transformation Hitachi Consulting aims to grow to US$ 1.5 billion annual revenues by FY2015 by Gerhard Fasol Hitachi Consulting announced on January 2, 2013 the acquisition of the UK based operations management consulting firm Celerant Consulting. Caledonia Investments announced the sale of its 47.3% ownership in…

-

Hitachi Europe acquires The Railway Engineering Company (TRE)

TRE supplies simulators and automatic routing systems by Gerhard Fasol Hitachi Europe expands European Traffic Managment Railways (TMS) sector Hitachi Europe, on December 20, 2012 announced the acquisition of The Railway Engineering Company (TRE) from James Fisher and Sons plc for UKL 25.5 million. The Railway Engineering Company (TRE) products include: Automatic Routing Systems Signalling…

-

Alpha Direct Services (ADS) acquired by Rakuten to build European logistics

Rakuten builds European logistics infrastructure Rakuten’s 6th acquisition in Europe Rakuten is aggressively globalizing in the face of intense competition by Amazon.com, and more recently Alibaba. As part of global growth, Rakuten is acquiring a string of e-commerce, e-book, online media, and software and service companies in Europe. Now Rakuten has started to build fulfillment…

-

Horizon Nuclear Power acquired by Hitachi for £696 million

Hitachi to build 6 GigaWatt of nuclear power in UK by Gerhard Fasol E.ON and RWE to withdraw, Chinese consortium lost bid In tune with Germany’s “Energiewende”, E.ON and RWE npower decided to sell Horizon Nuclear Power. On October 29, 2012 Hitachi Ltd (株式会社日立製作所) announced the agreement to acquire Horizon Nuclear Power for £696 million…

-

Aquafadas SAS acquired by Rakuten via e-reader company Kobo

Kobo acquires French digital publishing tool company Aquafadas Rakuten acquired e-reader manufacturer Kobo Rakuten acquired 100% of e-reader manufacturer Kobo for US$ 315 million in cash in January 2012. Kobo announced the acquisition of French digital publishing company Aquafadas on October 10, 2012. Aquafadas http://www.aquafadas.com was founded in Montpeller in 2004 by Matthieu Kopp (CTO)…